ARIZONA SCHOOLS GOT MORE MONEY THIS YEAR. WHAT’S IT FOR – AND IS IT ENOUGH?

Despite what the thermostat may say, summer is over for many Arizona students. School is back in session.

Lawmakers added money to K-12 spending for this school year – but how much? $1 billion? $800 million? Is this the big win it’s been depicted to be? Or is it a step in the right direction but with more to be done before we have the education system our children need and deserve?

NOT EVERYTHING IS AS IT SEEMS

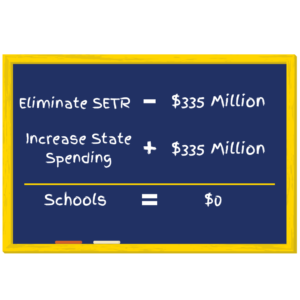

When $335 Million = Zero. Basic State Aid, the primary funding mechanism for Arizona public schools, is a mix of state dollars and local property taxes. This year, lawmakers eliminated the Statewide Equalization Tax Rate (SETR) – a property tax that raised about $335 million every year for Arizona’s public schools. Lawmakers used state dollars to fill the $335 million hole. So, while state general fund spending is up $335 million, property taxes will be down $335 million. That equals zero new resources for schools.

The funding shifts don’t stop with SETR. In 2021, lawmakers cut property taxes on commercial property, and they did the same thing again this year. Both times they used state dollars to replace the property taxes and hold districts harmless. Combined, these two years of tax cuts mean a $209 million property tax cut for commercial property owners and a $209 million increased cost to the state. For schools, though, it equals zero.

The funding shifts don’t stop with SETR. In 2021, lawmakers cut property taxes on commercial property, and they did the same thing again this year. Both times they used state dollars to replace the property taxes and hold districts harmless. Combined, these two years of tax cuts mean a $209 million property tax cut for commercial property owners and a $209 million increased cost to the state. For schools, though, it equals zero.

A MIXED BAG OF INCREASED AND NEW FUNDING

A MIXED BAG OF INCREASED AND NEW FUNDING

Inflation – Above and Beyond. Higher prices are hitting many families right now, be it at the gas pump, in monthly rent, or at the grocery store. Everyone feels the inflation that is increasing prices and causing us all to rethink our spending habits. Schools are no different-- from copy paper to fueling school buses, costs are up. Arizona lawmakers are required to increase school funding every year by the inflation rate or 2%, whichever is less. This year, lawmakers added 8.8% above what state law requires. On top of that, lawmakers also increased Additional Assistance, used to pay for transportation, technology, and textbooks, by $60 million. Altogether it adds up to $586 million. But with overall inflation reaching 9% and energy (including gasoline) at 42%, schools will still be behind.

Weighing Students. Arizona uses “weights” to calculate how much schools receive for each student. Lawmakers set the base level every year – this year it’s $4,775.27. This base amount is then multiplied by the “weights” that align with different student needs and characteristics. Students who cost more to educate have higher weights as a means to provide additional funding to their school. For example, an elementary student has a weight of 0.158 while a high school student has a weight of 0.105. Students from kindergarten through third grade receive an additional weight of 0.040 because the state requires schools to increase reading proficiency in those grades.

This year’s budget increased an existing weight and created one new weight:

Special Education Weight. The weight for one of the special education categories was more than tripled, from 0.093 to 0.292. That means $950 more per student and a $100 million increase to the K-12 budget.

Opportunity Weight. Educators agree that children in low-income families need additional supports and resources so they can thrive and be successful at school. This year lawmakers created a new “opportunity weight” (sometimes called a poverty weight) for students who qualify for the federal Free- and Reduced-Price Lunch program. The weight is set at 0.018 which produces $86 per qualifying student, adding $50 million for budget year 2023.

Addressing School Safety. School safety grants pay for school resource officers, juvenile probation officers, counselors and social workers on school campuses. Lawmakers added $50 million to provide a total $81 million.

Education for Adults. The Department of Education distributes funds to school districts, community colleges, counties, and community-based organizations to provide adult basic education, which includes GED preparation; English language acquisition; basic computer literacy; civics education; and adult secondary education. Lawmakers added nearly $17 million for a total $21.7 million for Adult Education.

Repairing and Maintaining School Buildings. Along with funding school operations, the state must also pay for building new schools as well as repairing and maintaining existing schools. At one time, Arizona had a building renewal formula which distributed dollars to every district each year. But lawmakers fully funded the formula only once and repealed it in 2019. Now, schools must compete for building renewal grants. This year’s budget includes just under $200 million for school building renewal grants. While this is more than the legislature has ever provided for these grants, it is still below the nearly $300 million the building renewal formula would have provided and does not account for the more than $3 billion that schools did not receive going back to 2005.

New Programs. This year lawmakers approved just under $1 million to create a new ongoing program and to continue a program that they previously funded for one year only:

Education in Jails. Provides $114,000 to expand education for individuals in county jails who are under age 21 and who do not have a high school diploma or GED.

Gifted Assessment. Last year’s budget included $850,000 to assess gifted students. This year’s budget makes the program ongoing by funding $850,000 each year going forward.

One-Time Funding. The budget includes $20 million in one-time funding. One-time funding can be used in two ways. 1) Start-up money for new programs and 2) One-and-done spending for items that are not expected to require subsequent investment. All of this funding is designated as one time, not to be repeated. But, as we saw from the Gifted Assessment program above, one-time funding sometimes becomes ongoing and many of the investments made this year could easily be continued.

- Childhood trauma awareness and prevention. $100,000 to provide childhood trauma awareness and prevention grants.

- Office of Indian Education. $5 million for the office, which is within the Department of Education

- Code writers initiative. $1 million to provide grants to develop and introduce computer code writing curriculum and technology-focused education for native American students.

- Foster care housing. $10 million to create transitional housing for foster youth who need stable housing to complete their high school diploma or GED and who are earning an industry certificate from the East Valley Institute of Technology.

- Electronic incentive prevention program. $150,000 for student safety grants.

- Postsecondary success program. $1 million to develop a pathway to higher education for students including financial education and a college savings match program.

- Assessment funding. Provides $4 million. The 2022 budget included $5 million for assessments.

More Staff for State Board of Education. Lawmakers approved three new positions for the State Board of Education: 1) Attorney General services for teacher misconduct cases. 2) Staff to promote the open enrollment program and provide constituent services. 3) Additional Policy Development staff. The budget also adds funds for the Education Scholarship Account (ESA) voucher appeals process.

WHATS MISSING

Paying for Universal Vouchers. Lawmakers passed HB 2853 in the last hours of the legislative session, opening up Empowerment Scholarship Account vouchers to any Arizona student. That amounts to about 85,000 students at an average cost of $7,000 – nearly $600 million if they all decided to take this “free” money. Lawmakers added $2 million for more staff to handle the new accounts but no dollars to actually fund them.

WHAT COULD HAVE BEEN

Schools Would Have Been Better Off if the Court Hadn’t Thrown Out Proposition 208. Prop. 208 was expected to raise $827 million a year from an income tax surcharge on Arizonans with the highest incomes. That’s about the same increase schools are receiving in the new budget. And Prop. 208 dollars would have gone to key purposes: pay increases for teachers, classroom, and support staff, Career and Technical Education Districts (CTEDs), the Arizona Teachers Academy. Some of the dollars in this year’s budget can be used for these purposes, but some are restricted as described earlier. If Prop. 208 were in place, lawmakers would still be required to adjust funding relative to enrollment growth and inflation, and likely would have chosen to fund some of the projects that ended up in the final budget -- increased funding for special education, creation of the opportunity weight, or additional inflation.

UNLESS LAWMAKERS LIFT THE SPENDING CAP, THESE NEW INVESTMENTS WILL MEAN NOTHING

It won’t matter how much lawmakers increased the K-12 budget if they don’t fix the “aggregate expenditure limit.” In 1980, Arizona voters approved a limit on what school districts are allowed to spend in a year. If schools exceed the limit, lawmakers can approve an “expenditure override” with a two-thirds vote in each chamber. This override allows districts to spend the funds lawmakers approved in the budget on a year-by-year basis. (The aggregate expenditure limit applies to districts only – not to charter schools.)

Districts already know their budgets are going to exceed the limit, partly due to the new dollars lawmakers approved. But they won’t know until November, when the Department of Education compiles information from all the districts, how much they’ll have to cut from their budgets if the expenditure override isn’t approved. Lawmakers have until March 1 to approve the expenditure override. If they don’t act, districts must cut their spending and submit new budgets by April 1. Last year lawmakers waited until 8 days before the deadline to approve overriding the limit. This year, until lawmakers act, the education for Arizona’s nearly 900,000 Arizona children is in jeopardy.

Read more about the aggregate expenditure limit here (Arizona’s Public Schools Face $1.1 Billion in Cuts this March if Legislature Does Not Override K-12 Spending Cap - The Arizona Center for Economic Progress (azeconcenter.org))