State Budget & Taxes

State Budget & Taxes

State budgets and taxes represent our shared priorities and values.

Taxes are critical to creating a thriving economy and society, providing the resources for investments in education, and overall well-being. The Arizona Center for Economic Progress works to ensure state resources are adequately funded and tax fairness is a driving force behind strong communities.

The Impact of Decades of Tax Cuts and Federal Policy on Arizona's Economic Future

Just last month, the Arizona Financial Advisory Committee (FAC) met to discuss the revenue and economic outlook for Arizona. While the panel of economists and Joint Legislative Budget Committee (JLBC) staff had projected…

REVENUE UPDATE: WE CANNOT AFFORD ANY MORE TAX CUTS

Last month, the Joint Legislative Budget Committee (JLBC) presented its fiscal year 2026 (FY2026) baseline and revenue forecast at their January Financial Advisory Committee (FAC) meeting. What is the JLBC baseline? The…

SB1080 Could Strengthen Tax Credit Review Process but not if the Tax Credit Review Committee Never Meets

Arizona has a variety of tax credits available to taxpayers. In its wisdom, the legislature created the Joint Legislative Income Tax Credit Committee in 2002 to keep an eye on credits, including revenue and economic impact…

Looking to Arizona's Next State Budget

On January 13, 2025, a new Arizona legislature will be sworn in and begin forming the 2026 state budget. Today’s budget outlook is significantly different from what legislators faced last January. Then, the state faced…

Prop 312's Impact: A Threat to Local Budgets and Homelessness Policies

Proposition 312 (Prop 312) produces an economic sanction on local communities and is a short-sighted approach to an issue that requires local solutions, not a one-size-fits-all statewide initiative. If passed, Prop 312…

From Flat Tax to Funding Dilemmas: Arizona’s Budget Struggles

Working late into the night on a Saturday, the state legislature passed legislation to resolve an almost $1.6 billion deficit for fiscal years 2024 and 2025. The state found itself in this dire predicament after it learned…

Clock Ticking: $715 Million Deficit Still Looms

Since last October, fiscal analysts have been warning that the state’s revenues are not sufficient to support the budget that was passed a year ago. The latest Monthly Highlights issued by the Joint Legislative…

Tax Day Tip: It’s Time to Face Reality That State Revenues are in Disarray

Governor Hobbs and the state legislature have until June 30 to pass a budget. The major problem they face is state revenues that are lower than expected when they passed the budget last year. They need to not only adopt a…

Arizonans with Highest Incomes Pay Much Less in Taxes than Other TaxPayers

A new report released by the Institute on Taxation and Economic Policy (ITEP) highlights how recent tax policy changes have increased inequity and decreased fairness among taxpayers depending on income. In Who Pays? Seventh…

$100M in Gov. Hobbs budget proposal for child care.

Our thanks to Governor Hobbs for prioritizing child care in her budget proposal. On Friday afternoon, the Governor released her budget proposal signifying her priorities for the upcoming legislative session. Included in…

AZCenter 2024 Legislative Agenda

State budgets and taxes represent our shared priorities and values. The Arizona Center for Economic Progress (AZCenter) advocates for a state budget and tax structure that builds stronger economic opportunities for all Arizonans,…

Tribal Tax Primer: A Deep Dive into Arizona's Tribal Tax Landscape

The state of Arizona is home to 22 federally recognized Native American tribes whose lands comprise 27 percent of the state’s landmass.¹ Arizona tribal reservations can be found throughout the state, from Four Corners…

Arizona Legislature Once Again Shirks its Responsibility to Review Billions of Dollars in Tax Credits

State law requires the Joint Legislative Income Tax Credit Review Committee to submit a report of its findings and recommendations to the Governor and legislative leadership by December 15. Four tax credits were scheduled…

Arizona Will Lose $14.2 billion to Tax Cuts by 2028

In recent years, policymakers in Phoenix joined their counterparts in more than half the states across the country on a historic revenue-reduction spree that shifted public funds away from public investments and toward tax…

A PRELIMINARY LOOK AT THE STATE BUDGET AND REVENUES

The last couple of weeks have given us a glimpse into what is likely to be a difficult session when the legislature returns in January: Significant funding needs with declining revenues. Funding needs are high. On September…

Is the Arizona Legislature Gambling with the State’s Fiscal Future?

As reported by the Arizona Republic’s Mary Jo Pitzl , enrollment in the Empowerment Scholarship Account (ESA) program is expected to far exceed the projections assumed in the budget. In late May, the Department of Education…

School Vouchers Lack Necessary Transparency and Accountability

This post is part of a series including Arizona School Vouchers, Explained, School Voucher Costs Have Risen Much Faster Than K-12 Funding Increases, and School Vouchers Lack Necessary Transparency and Accountability. ESA…

School Voucher Costs Have Risen Much Faster Than K-12 Funding Increases

This post is part of a series including Arizona School Vouchers, Explained, School Voucher Costs Have Risen Much Faster Than K-12 Funding Increases, and School Vouchers Lack Necessary Transparency and Accountability. In recent…

Arizona School Vouchers, Explained

This post is part of a series including Arizona School Vouchers, Explained, School Voucher Costs Have Risen Much Faster Than K-12 Funding Increases, and School Vouchers Lack Necessary Transparency and Accountability. For…

Extending the 2017 Tax Cuts and Jobs Act Will Further Solidify An Unequal Federal Income Tax Structure for Generations

A new report from the Institute on Taxation and Economic Policy (ITEP) predicts that making permanent the temporary provisions of the 2017 Tax Cuts and Jobs Act (TCJA) will cost nearly $290 billion in 2026. H.R. 976, the…

Arizona’s New Budget Will Improve the Lives of Many. Only Time Will Tell If It Provides Budget Stability.

The new state budget brings a ray of positivity for countless Arizonans, with numerous aspects to appreciate. There’s increased funding for university scholarships, an expansion of KidsCare, and even a tax rebate, all...

Arizona's Voters Deserve a Say in the State's Budget

The voices of voters are once again being silenced. After several moves that are undemocratic, lacking in transparency and clearly an attempt to rush through billions of dollars of taxpayer money with almost zero input from…

Press Conference To Feature House Minority Leader Andres Cano & Senate Minority Leader Mitzi Epstein Joining Power Building Organizations Showing a Unified Front on PFE Priorities!

The People’s First Economy annual advocacy day arrives at a pivotal moment; following the recent expulsion of Liz Harris, legislators are set to return from their recess on April 25, and budget negotiations have reached...

ARIZONA LEGISLATURE MUST PUT FAMILIES AND CHILDREN FIRST IN TAX POLICY

On Tax Day, we’re asking the Arizona State Legislature to pass tax policies that prioritize the needs of families. The strength of our society and economy depends on public investments in services and needs, like paid family…

Colorado legislators warn AZ leaders about harmful tax cut proposal

As Arizona legislators consider SCR1035, which would impose tax and spending limitations like those in Colorado, the AZCenter believes it is critically important to look at the consequences automatic tax cuts will impact…

Stop SCR1035/SB1577

A PROPOSAL FOR AUTOMATIC INCOME TAX CUTS SOUNDS BENIGN BUT WOULD EVENTUALLY CAUSE GREAT HARM TO MANY ARIZONANS Understanding the Real Costs of Arizona SCR1035 and SB1577 The Arizona Legislature Senate Concurrent Resolution…

AZCenter Priority Bills: What We Support and Oppose to Build a Future for All Arizonans.

This legislative session, the AZCenter has identified 16 Priority Bills that will impact resources to create a better opportunity for all Arizonans. Bills like SCR 1035 and SB1577 would require the Arizona Department of Revenue…

The Clock is Ticking – AZ Students Need a Permanent Fix to The School Spending Limit

Just as they did in 2023, this year’s legislature preemptively lifted the school spending limit for the 2024 – 2025 academic year, far ahead of the March 1, 2025, deadline. But the clock continues to tick—now toward…

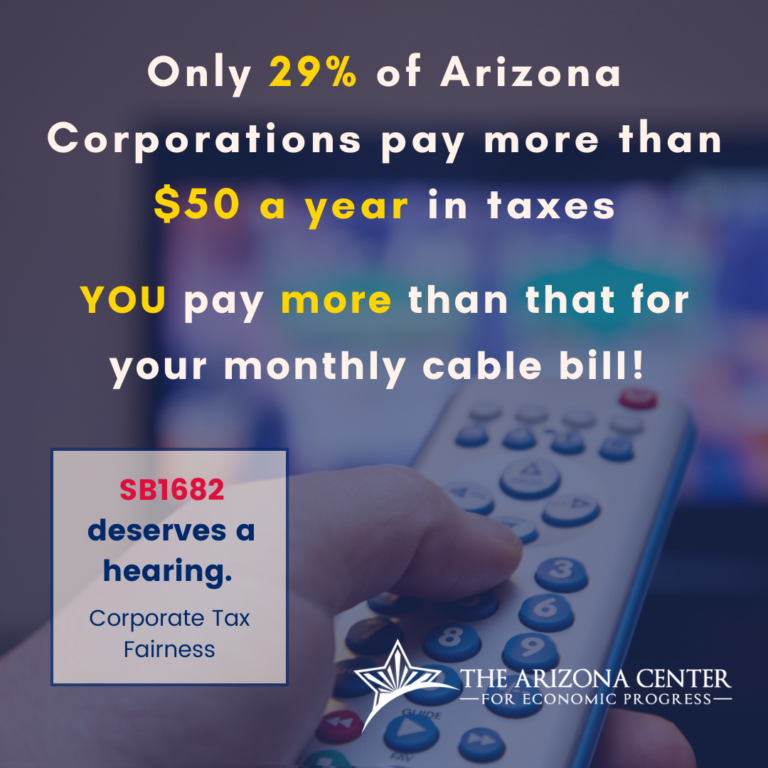

SB1682 Fact Sheet

In Arizona, only 29 percent of corporations pay more than $50 in state income taxes. Most of us pay more than that for our monthly phone bill. For more than 30 years, corporations have received billions of dollars of tax…

Arizona Legislature Introduces a “Skinny” Budget to Avoid Working for Consensus. The Governor Proposes a Full Budget that Meets Many of the Needs of Arizonans

On January 9, Governor Hobbs released her budget proposal to address the needs of Arizonans. This week, the legislature ignored the Governor’s proposal and introduced bills to adopt a “skinny” budget. These bills…

Creating more sales tax exemptions will make it harder for those in need.

Governor Hobbs and a bipartisan coalition of lawmakers are supporting a proposal that would make all purchases of tampons, sanitary napkins and other feminine hygiene products exempt from sales tax. It is estimated the exemption…

Diaper Sales Tax Exemption Provides Little Help for Low-Income Parents

Instead of eliminating the sales tax on diapers, lawmakers should establish a direct assistance program to cover most or all of the cost of diapers for low-income families. Governor Hobbs and a bipartisan coalition of lawmakers…

Governor Ducey needs to act now to prevent $1.4 billion cut to Arizona’s school districts

The school spending cap known as the Aggregate Expenditure Limit (AEL) is once again threatening the new investments the legislature and governor made to K-12 education. Arizona’s school districts will be forced to cut…

Extreme Wealth Inequality

Less than 0.2% of Arizona Hold Nearly $500 Billion in Wealth According to a new report by our partner Institute on Taxation and Economic Policy (ITEP) a small fraction of Arizonan families holds more than $500 billion in…

The importance of school's spending limit

Arizona’s public school districts will be required to cut their budgets by $1.3 billion if the legislature does not act by March 1, 2023 to lift the state constitution’s school spending limitation. If that sounds familiar,…

2022 Legislative Session & Budget Recap

Last week, the Arizona Legislature passed a budget and concluded a long and unpredictable 2022 session. This year, politicians at the State Capitol had a historic opportunity to use a massive surplus of resources to make…

The Bad, Inadequate, & Missing – AZCenter’s take on the latest state budget proposal

With only eight days left before the deadline (and a state government shutdown), the Arizona Legislature has begun serious negotiations on a state budget proposal revealed this past Monday. As the AZCenter has previously…

Arizona should use its surplus to invest in the future, not in another tax giveaway.

As Arizona’s economy continues its rapid recovery and expansion—in large part thanks to federal relief legislation that kept families afloat and businesses open—Arizona’s state revenues have skyrocketed, resulting…

$2 Billion Tax Cuts for the Rich are Irresponsible

Last year, the legislature passed huge tax cuts whose benefits will only be seen by the richest Arizonans. Right now, Arizona’s finances are healthy with an expected $5 billion surplus. But this sunny forecast is in danger….

Movie Production Incentives instead of state investments

This session, the Arizona state legislature aims to pass legislation that would reintroduce tax credit incentives for the motion picture industry. Senate Bill 1708 would establish the Arizona Motion Picture Production Program…

The better the bill, the harder it falls

This year, state lawmakers in Arizona introduced nearly 1700 pieces of legislation. Committee chairs, using their power through rules and deadlines, select which bills receive a hearing for consideration. Every year many…

Arizona’s Public Schools Face $1.1 Billion in Cuts this March if Legislature Does Not Override K-12 Spending Cap

Arizona’s district schools will cut their budgets for the current school year by $1.1 billion if the legislature doesn’t act by March 1, 2022, to override the state constitution’s school spending limitation. In 1980,…

State legislature fails to prioritize Tribal post-pandemic needs

The 2021 Arizona legislative session was historic, not only in terms of its length, but also in the largest permanent tax cuts in three decades. For thirty years, continuous tax cuts have contributed to the systemic divestment…

The flat tax falls flat for most Arizonans

The Arizona legislature is poised to permanently cut over a billion dollars in state revenues, the largest tax cut in the last three decades. This cut will make Arizona’s tax system more regressive than it is today with…

State Budget Proposal Creates Structural Deficit to Give Tax Breaks for the Rich

Lawmakers are considering a state budget proposal that will shrink state revenues by more than $1.5 billion each year, gives huge tax breaks to the rich, and will create a structural deficit starting in fiscal year 2023….

Our chance to invest in a People First Economy for Arizona

Abundance and bounty are not words typically associated with a state known for its harsh desert landscape. But when it comes to Arizona’s public resources—for once—there is plenty. According to the Joint Legislative…

Legislature’s Flat Tax Proposal Will Cut Revenue for Arizona’s Cities and Towns by $225 Million

The proposed 2.5% flat tax rate and the 4.5% total cap on any income taxes would not only mean a $1.9 billion cut to state revenues, it would also mean a cut to the urban revenue sharing dollars Arizona’s cities and towns…

Arizona's regressive tax policy contributes significantly to economic and racial injustice

Tax policy plays a role in the fight for economic and racial justice. The type of tax and how it is structured matters. A new report issued by the Institute for Taxation and Economic Policy (ITEP), Taxes and Racial Equity…

Stop politicians from destroying Arizona’s future

Thousands of Arizonans are facing huge challenges during the COVID-19 health and economic crisis. Many have lost their jobs or are working reduced hours, struggling to put food on the table. And many small businesses are…

SB1783 is a tax cut for the rich and does nothing to help small businesses

Senate Bill 1783 allows rich individual tax filers to remove profits from their businesses, trusts, and estates from the calculation of their individual taxable income so that they can avoid paying the surcharge established…

What did the Arizona legislature miss this year?

This year, state lawmakers in Arizona introduced more than 1,800 pieces of legislation. Committee chairs, using their power through rules and deadlines, select which bills receive a hearing for consideration. Every year…

Tax cuts on the horizon in Arizona (yet again)

The economic shockwaves from the COVID-19 pandemic have by no means subsided. According to our recent analysis of Household Pulse Survey data, 1 in 3 households in Arizona cannot afford usual expenses, 1 in 6 renter households…

Governor Ducey's budget proposal

At a time when Arizona is experiencing among the highest rates of COVID in the nation and world, it is critical to examine how the state allocates its resources to address the needs of struggling Arizonans. Amidst the onset…

Legislators should consider new revenue options for addressing state budget shortfall

The Arizona legislature has cut taxes every year but one since 1990 and all of those tax cuts combined have reduced state revenues by more than $5 billion when adjusted for inflation. Many of those tax cuts over the years…

We Need to Protect Arizona’s Tenants

In 2018, before COVID-19 and its economic fallout, nearly 9 in 10 Arizonan households with extremely low incomes spent more than half of their income on housing—leaving little room for emergency expenses. Many low-income,…

Supermajority Requirement for Raising Revenues Jeopardizes Arizona’s Economic Future

Arizona’s constitution requires a super-majority (two-thirds) vote of both chambers of the legislature to raise revenue through increased taxes or to reduce or eliminate tax credits, tax exemptions, or deductions – even…

Using Increased Revenues from Conformity on More Tax Cuts is Fiscally Irresponsible

Two reports show that conforming Arizona’s tax code to the 2017 federal tax changes will result in a net increase to Arizona’s General Fund revenues in fiscal year 2020, although the two reports differed in the amount…

Are State Lawmakers Working for a Fairer Tax Code for All Arizonans?

The Arizona legislature has cut taxes every year since 1990, resulting in $4.4 billion less in annual state revenues when adjusted for inflation. But most Arizonans have not benefited from the almost three decades of annual…

Bill to Increase Charitable Deductions Comes with Tradeoffs

The federal tax changes passed by Congress in 2017 preserved the charitable deduction for those who itemize their taxes. However, because the tax changes doubled the standard deduction, fewer people are expected to itemize…

A Tax Cut for Military Retirees Leaves Most Veterans Behind

SB1167 provides a small tax cut for military retirees who receive a military pension, but leaves out 90% of Arizona veterans. SB1167 will reduce state revenues by $15 million and will make it more difficult to invest in the…

Wrong Priorities: It Doesn’t Make Sense to Give a Tax Cut to the Rich While Arizona Asks Children in Public Schools to Wait

Arizona stands to gain $130 million to $230 million in General Fund revenues if it conforms the Arizona tax code to the federal tax changes enacted in 2017. Rather than directing those additional revenues to better prepare…

What are the Neighbors Doing?

For several years, tax cuts have been the tool of choice that many states have used to try to make themselves more competitive and to attract new businesses and jobs to their state. However, many of those same states are…

Kansas Tax Cuts Failed to Spur Jobs and Economic Growth

Kansas Governor Sam Brownback was elected in 2010. Soon thereafter he launched a “pro-growth tax policy” of dramatic cuts for business and high-earning individuals in 2012 that he promised would be a “shot of adrenaline…