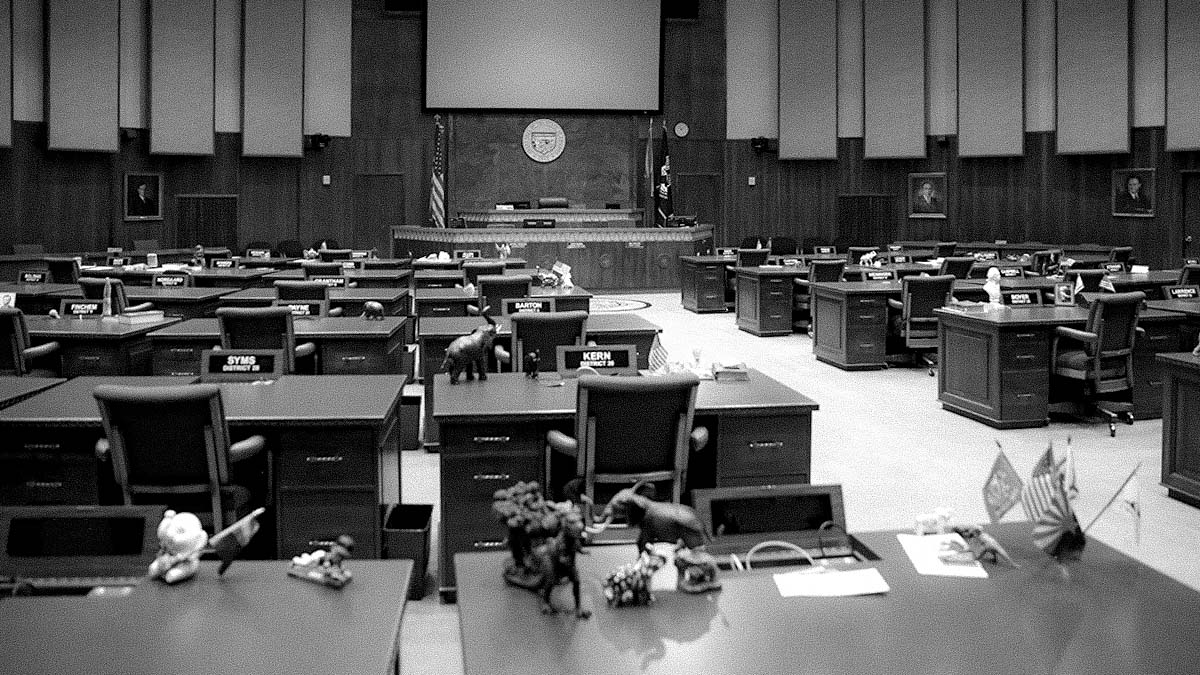

2021 Legislative Session & Budget Recap

Missed opportunities, undermining the will of voters, and long-term fiscal consequences

This legislative session, politicians at the State Capitol had a historic opportunity to use a massive surplus of state and federal resources to make long-term investments and improve the economic well-being of all Arizonans. Yet sadly, they squandered this chance by giving billions of dollars to the wealthiest household, negating the will of the voters as expressed through Proposition 208 and surrendering the ability to invest in Arizona’s future. The enacted budget is the latest and most egregious in a long tradition of prioritizing tax cuts, credits, and deductions that tilt the scales of state finances in favor of the those with high incomes.

Not in recent memory did state lawmakers wield such a windfall of resources. With revenues repeatedly beating cautious forecasts thanks to federal relief, General Fund ongoing and cash balances were forecasted to exceed $6 billion over the next three years. This, combined with over $12 billion in one-time federal funds from DC through the American Rescue Plan Act, gave elected officials an unprecedented opportunity to address longstanding needs across the state and build a people first economy. For once, a lack of funds was no excuse for refusing to make these crucial, overdue investments (all of which could happen without raising taxes).

Yet instead, state legislators and Governor chose to continue to cater to those with the highest incomes with a massive tax cut package. By enacting a plan lower tax rates to 2.5% for all, and to cap the top marginal rate at 4.5% in the coming years, the top 5% of households (those making over $224,000per year) will claim over 75% of the total tax benefits. This means that lower-income households will still pay significantly more in taxes (as a share of their income, after deductions and credits) than the wealthiest households in the state.

Where the tax cuts were tilted in favor of the rich, they were also slanted against Arizona voters. The 4.5% top marginal rate cap in the budget and the alternative income tax passed through Senate Bill 1783 will directly undermine Proposition 208’s surcharge on high-income households by reducing their contributions to the General Fund (in the case of the rate cap) or avoiding paying the Prop 208 surcharge altogether (in the case of SB 1783). These measures add to a troubling pattern of anti-democratic actions taken this legislative session to overturn the will of Arizona’s voters.

These lopsided tax cuts come at the expense of critical investments in things to improve the economic opportunity and well-being of all Arizonans.

What’s missing from Arizona’s budget?

- Strong investments to build and maintain affordable housing and address homelessness as housing prices continue to soar

- A comprehensive, statewide paid family and medical leave program so workers don’t have to choose between a paycheck and caring for a newborn or loved one

- Additional resources for families helping take care of foster children (or the children of relatives) in the foster care system

- Strong investments in school building renewal and facilities so a school district’s poverty rate doesn’t impact learning conditions

- Restoration of funding for community colleges in Maricopa and Pima County so they can shape Arizona’s growing workforce

- Expanding children’s health insurance through KidsCare so fewer families fall through the cracks in accessing health care

- Carrying out promises for more financial aid for public university students as they face record increases in tuition and fees in recent years

- Pay raises for state employees whose salaries remain low and uncompetitive

- Increased K-12 education funding to eliminate the remnants of Recession-era cuts and implement full-day kindergarten

- Increased funding for behavioral health services so more people have access to affordable help

Given that many of these changes will be phased-in, this budget and tax plan will force hard decisions on elected officials in future years. Increasing revenue through changes in Arizona’s tax code requires a two-thirds majority of the state legislature. With the surpluses gone to tax cuts, raising the resources for the things that matter becomes even more difficult.

When Arizona voters passed Proposition 208, they made it clear this was not the direction they wanted the state to go. Unfortunately, the legislature did not heed this signal, and so voters may have to return to the ballot box to send this message once again.