A Tax Cut for Military Retirees Leaves Most Veterans Behind

SB1167 provides a small tax cut for military retirees who receive a military pension, but leaves out 90% of Arizona veterans. SB1167 will reduce state revenues by $15 million and will make it more difficult to invest in the assets veterans deserve and need to create better economic opportunities for them and their families.

SB1167 would only help 10% of all veterans

Servicemembers must stay in the military for a full 20 years before they qualify for retirement pay. In Arizona, about 52,000 of our 515,000 veterans receive retirement pay. Not all veterans with a military pension need a tax cut. Those veterans with pensions were often officers in the military with stronger skills and training that enable them to have greater earnings prospects in second careers after leaving the military.

Louisiana provides an example of how AZ can help more than 10%

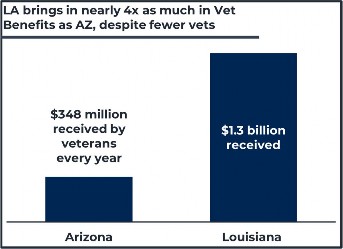

Veterans need help from Veteran’s Benefits Counselors (VBCs) to navigate the mountains of paperwork required by the VA to receive the benefits owed to them every year. Louisiana has half as many veterans as Arizona, but employs twice as many VBCs. It pays off – Veterans in Louisiana receive $952 million more every year than veterans in Arizona. That money supports veteran families and goes straight into the economy as veterans spend their benefits on healthcare, education, and other daily needs.

Veterans want to pay their fair share

SB1167 is an example of tax policy that picks winners and losers, instead of requiring all Arizonans to pay their fair share. “I served to defend the Nation, not to get tax breaks. It would be better to put these dollars into our public education system and other priorities.” Retired Colonel Peter Huisking (served 25 years in the U.S. Army, including Europe, Korea and Desert Storm). Red Cross volunteer at Army clinic, Ft. Huachuca. Veterans with a pension and financial stability will want to pay their fair share of state income taxes to support public schools, public health and safety. Like other Arizonans, they know we cannot prepare our next generation for military service or college or career without investments in our public schools and the other priorities that enable our communities to thrive.