Arizona should use its surplus to invest in the future, not in another tax giveaway.

As Arizona’s economy continues its rapid recovery and expansion—in large part thanks to federal relief legislation that kept families afloat and businesses open—Arizona’s state revenues have skyrocketed, resulting in a surplus of $1.6 billion in ongoing resources and $3.7 billion in one-time resources. While some legislators want to continue to cut taxes and create more tax breaks for the wealthiest households and corporations, Arizonans are demanding long-term, overdue, and necessary investments to create an economy that works for everyone. Instead of another round of giveaways, Arizona can invest its surplus right now into these key priorities:

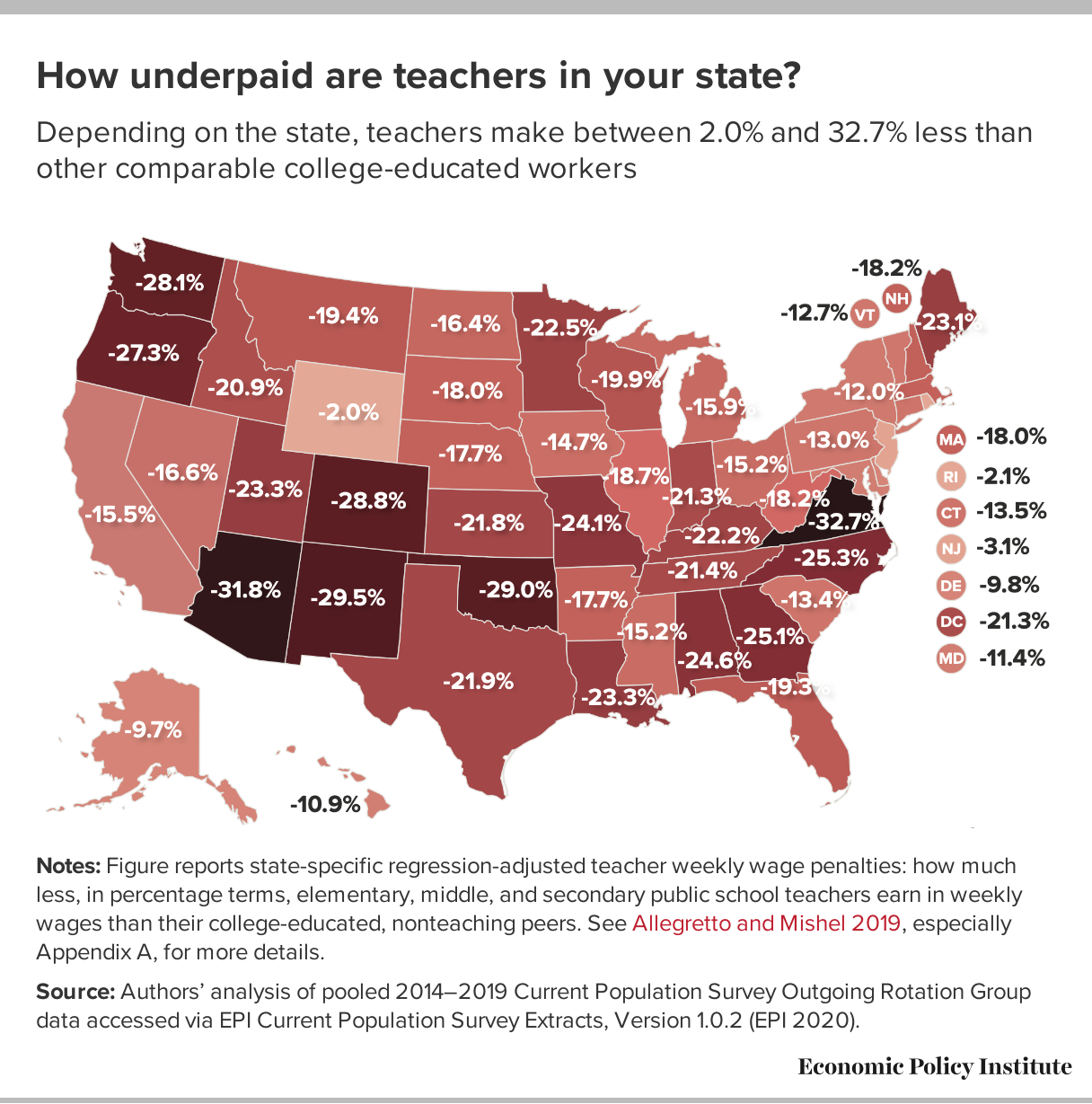

K-12 Education

With one of the lowest investments in per-pupil K-12 education in the country, Arizona has underfunded its schools for years and it’s time for change. Nearly 1.7 million Arizonans made this known by passing Proposition 208 at the ballot in 2020. While the Arizona Supreme Court struck Prop. 208 down on a narrow technicality, this year the legislature can choose to add new permanent investments into K-12 classrooms—without raising taxes. The legislature can reverse accounting gimmicks (like the “rollover” which continues to defer over $866 million in payments to school districts), restore full-day kindergarten, update outdated school facilities, and adequately pay school professionals so they can be retained into the future. Investing in our public schools, particularly those serving a higher share of students experiencing poverty, will strengthen the state’s economy now and in the long term.

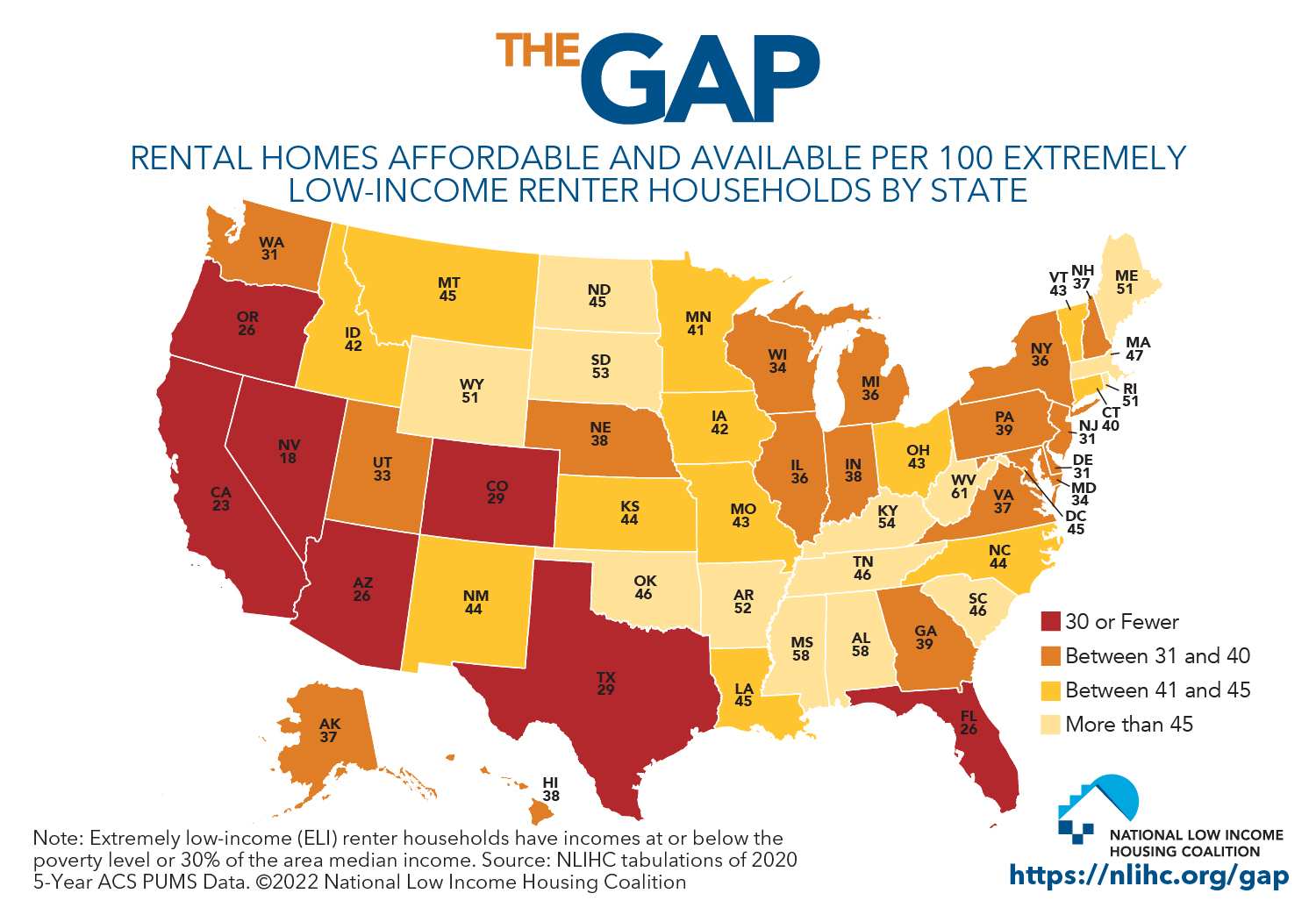

Affordable Housing

Rent and housing costs have been rapidly increasing in Arizona, reflecting a deep shortage that began well before the pandemic. According to the National Low Income Housing Coalition, for every 100 households with extremely low incomes, only 26 homes are available and affordable for them to live in—a figure nearly as low as California and Nevada’s. Yet at the same time, Arizona spends very little on housing assistance or building affordable housing. To address this crisis, over 165,000 rentals for low-income households would need to become available in Arizona. The legislature can direct more resources and protections to help those who are struggling to afford housing. Arizona can also use its surplus to subsidize the construction of affordable housing through ongoing investment in the state’s Housing Trust Fund, re-empowering local governments, and eliminating unnecessary barriers at the local level. As Arizona’s economy continues to grow, getting housing costs under control will be crucial to making sure everyone can share in the state’s prosperity.

Child Care

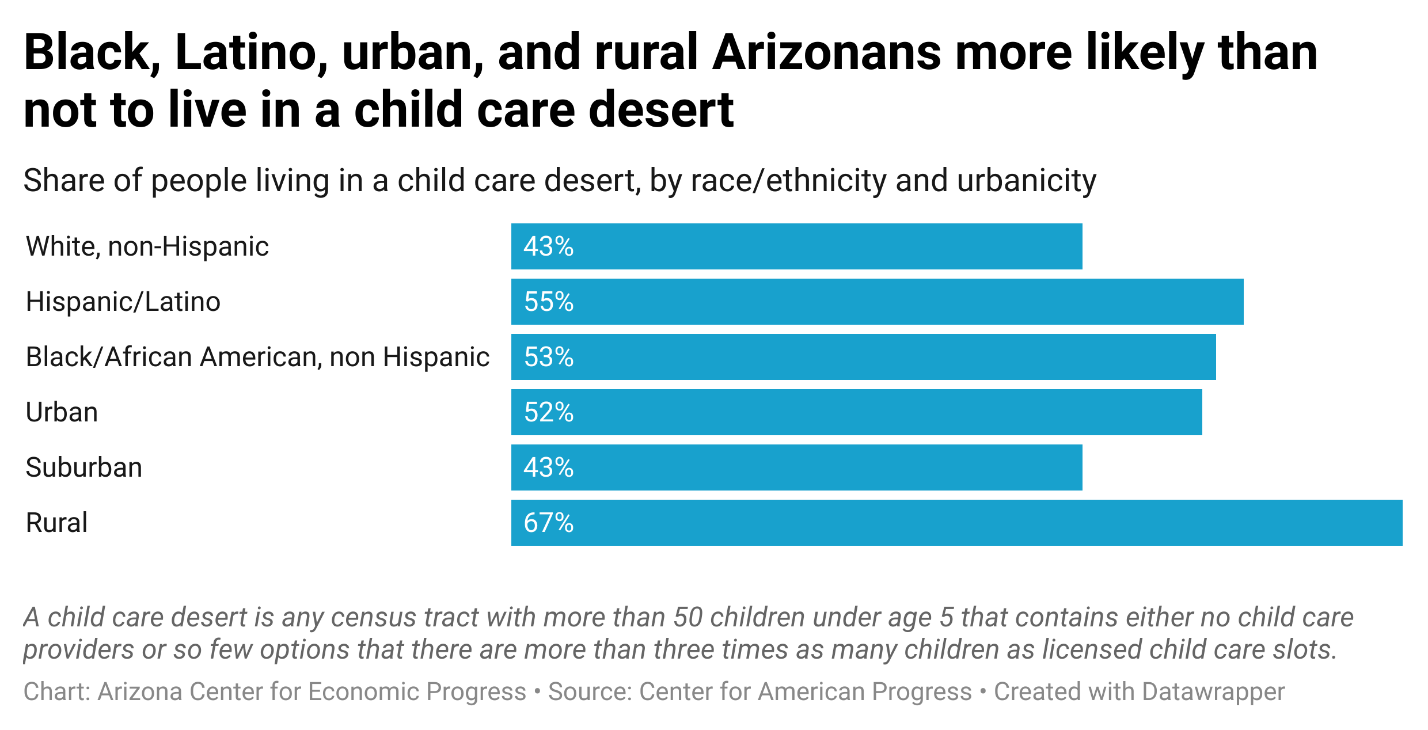

Child Care

Just like roads, bridges, and internet make it easier for Arizonans to thrive, so too does child care, an important element of “human” infrastructure. Yet, child care is inaccessible to many Arizona families who seek it—either because it has become too expensive or because there are not enough providers to meet the demand. Approximately half of Arizona families live in a “child care desert”, and without action by the state legislature, that share will continue to grow. Arizona can use its surplus to make sure that all families can access affordable, quality child care, including those with non-traditional work schedules. Investing in child care through increased assistance and programs to boost family, friend, and neighbor providers can give families more stability and opportunity, boost the vital care economy, and help more Arizona children become ready for school.

Higher Education

Higher Education

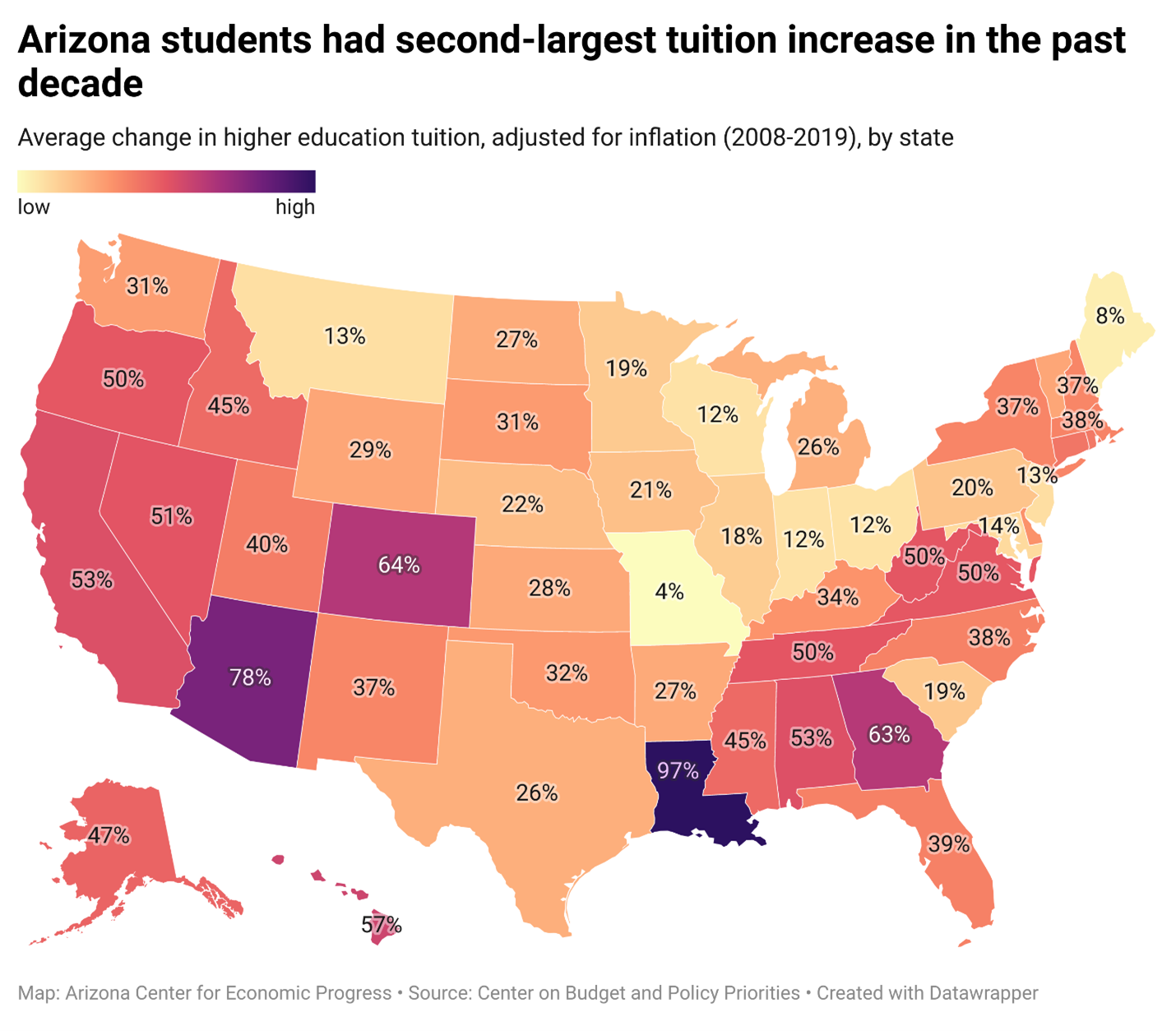

An accessible, well-funded higher education system is crucial for improving Arizona’s economy and to create thriving communities. Deep cuts in funding to public universities and community colleges have contributed to large, rapid tuition increases over the last decade—pushing more costs onto students and making it harder for them to enroll and graduate, particularly for low-income students and Latino, American Indian, and Black students. Too many students and families are burdened with debt or unable to afford college altogether. This year, Arizona can use its surplus to live up to past promises and restore crucial financial aid funds for low-income students through the Arizona Financial Aid Trust. Instead of the legislature depositing only $10 million dollars, the state can restore the full $43 million dollars statutorily required and create new dedicated funding sources to assist non-traditional students pursuing higher education with more opportunities.

Broadband

Broadband

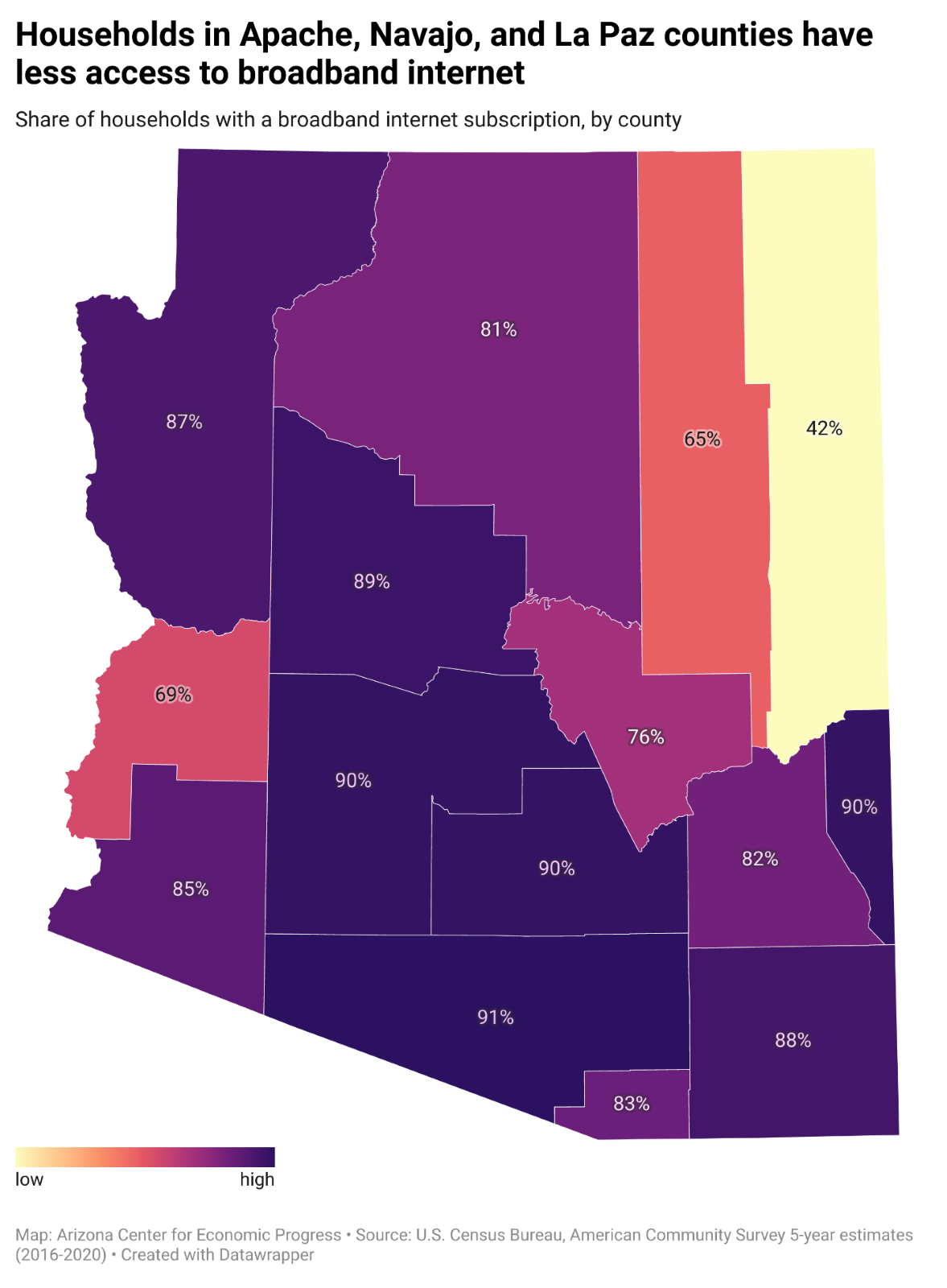

The pandemic demonstrated just how crucial reliable, high-speed internet is to Arizona’s communities and economy. Yet, far too many Arizonans, particularly those in rural areas and on tribal lands, lack the access they need to learn, work, and connect. While Arizona will receive major broadband investments thanks to the federal Infrastructure Investment and Jobs Act and new federal Broadband Affordable Connectivity Program, these projects can be supplemented with state resources to connect even more Arizonans.

Health Coverage

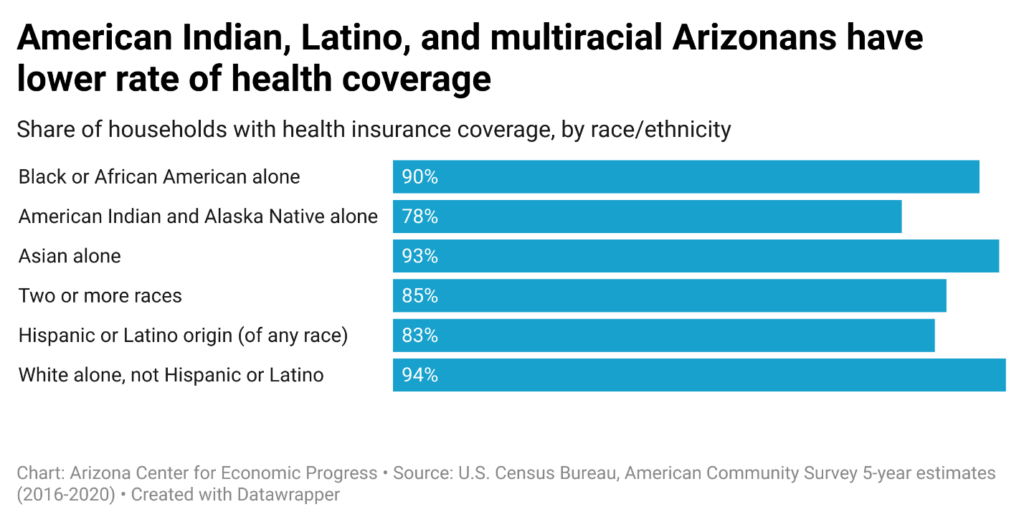

According to recent polling, 61 percent of Arizonans are very concerned about the cost of health care. More than 1 in 10 lack health insurance coverage, putting Arizona in the bottom ten when compared to other states, and fourth-lowest in the country when it comes to the rate of uninsured children. Arizona should invest its surplus of state resources to make sure health care is affordable and accessible for more families. This includes making important enhancements to Medicaid for children and families, including: extending postpartum coverage from 60 days to twelve months after pregnancy, offering comprehensive adult dental coverage, providing a year of continuous coverage to children who participate in Medicaid and CHIP, waiving the five-year waiting period for lawful permanent residents (LPRs), and eliminating barriers to enrolling and retaining health coverage.

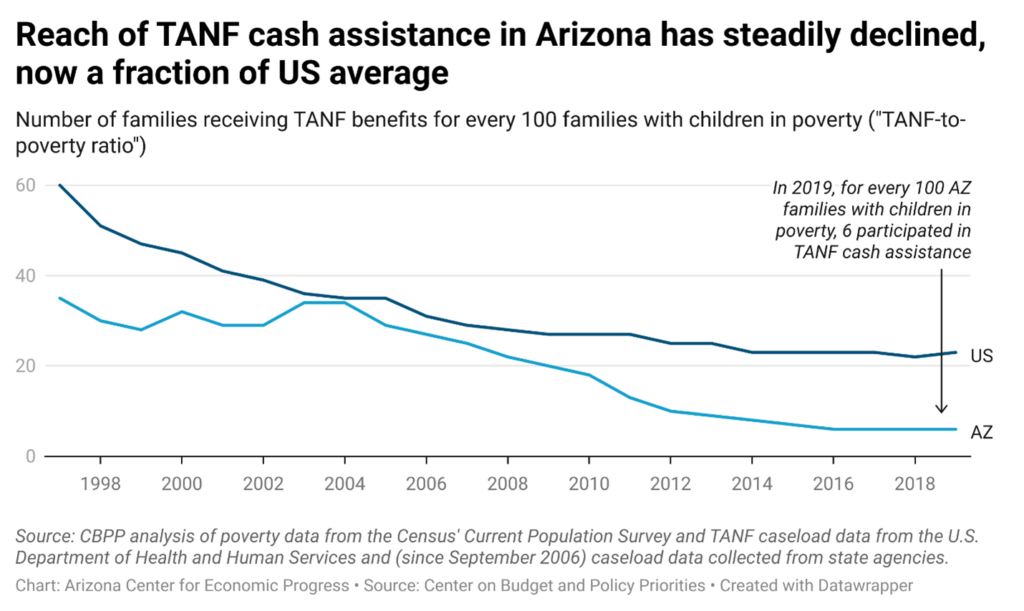

Income Supports

As households face higher costs due to inflation, fuel prices, and supply chain disruptions, Arizona’s safety net programs should provide a backstop for more low-income families struggling to afford their usual expenses. Since the Great Recession, benefits have eroded and held back households from accessing basic supports like cash assistance, school meals, and unemployment insurance. For example, for every 100 families experiencing poverty, only 6 are enrolled in the state’s cash assistance program. Arizona can use its state surplus to restore these programs, lower barriers, and improve the adequacy of benefits so they can serve more people when they are needed.