Arizona’s Public Schools Face $1.1 Billion in Cuts this March if Legislature Does Not Override K-12 Spending Cap

Arizona’s district schools will cut their budgets for the current school year by $1.1 billion if the legislature doesn’t act by March 1, 2022, to override the state constitution’s school spending limitation. In 1980, Arizona voters approved a limit on what public schools are allowed to spend in a year. If schools exceed the limit in a school year, as they have this year, the law allows the legislature to provide an “expenditure override” with a two-thirds vote in each chamber. An expenditure override doesn’t increase taxes and is independent of the legislature’s budget decisions during its 2022 session. It simply allows districts to spend funds they have already received and budgeted for this school year.

The spending limit is antiquated and based on what school needs were like in 1980. That is evident by the fact that Arizona is hitting the spending limit this year despite Arizona school funding being the lowest in the nation. Without the expenditure override, schools will be forced to make draconian cuts before the end of this school year. It would be an economic disaster for Arizona schools, which are already experiencing a teacher shortage and struggling with additional costs caused by the pandemic.

When it returns in January, the Arizona legislature must:

(1) By March 1, pass a resolution to override the limit for the current school year.

(2) Send a referral to the November 2022 ballot to permanently address the limit.

The History of Spending Limits in Arizona. In 1978, California voters passed “Proposition 13” which made significant changes to how property was valued for taxation purposes and how property taxes were assessed. Although Arizona voters defeated an Arizona version of Prop 13 in 1980, they had previously passed major changes that created limits on property valuations and property tax rates. Arizona voters also approved individual spending limits for cities and towns, counties, community colleges, and an aggregate limit for school districts, all of which depend on property taxes for revenue.

The Economic Estimates Commission calculates separate spending limits for each city and town, county, and community college. However, the limit for Arizona’s public school districts is aggregate – a single limit is calculated for all school districts. Charter schools, which are also public schools but did not exist in 1980 when the law was passed, are not subject to the aggregate spending limit.

The 1980 ballot also included a new public school funding formula which “equalized” funding across all public school districts. No longer would a school district’s budget be dependent on the value of property within district boundaries or the ability to raise taxes. The new formula consists of three components: the base support level, the transportation support level, and district additional assistance. The transportation support level is based on student transportation route miles. The base support level and district additional assistance are based on a “weighted” student account which makes adjustments for student characteristics such as grade level and special needs. An equalization tax rate, set each year by the legislature, is used to calculate the property taxes for each school district. If that calculation does not produce enough revenue to fully fund the equalization base, the state General Fund pays the difference.

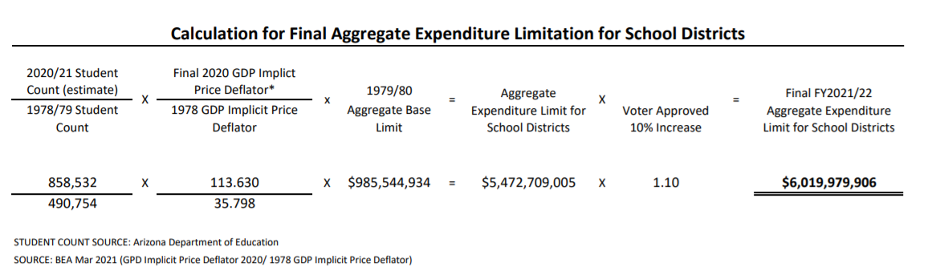

How the Expenditure Limit Formula is Calculated. A calculation limits Arizona school district spending based on 1979-80 school spending adjusted for changes in the number of students and inflation, plus an additional 10%. Federal and state project funds, carry-forward balances, and revenue raised by voter-approved tax increases through an override are excluded. If the sum of all district school budgets across the state exceeds the limit produced by the formula, the legislature can override the limit. If the legislature does not act by March 1, all the districts must cut their budgets to stay within the limit. The calculation for the 2021-22 school year is:

The Timeline. The 13-month timeline for the expenditure limitation process begins in March of the previous year with the calculation of the expenditure limit for the following school year. In November, it is determined whether the expenditures will exceed the limit, and if so, the legislature has until March 1 to approve exceeding the limit. If the legislature does not approve exceeding the limit, schools must submit a revised budget in April.

Arizona Districts Have Been Approaching the Limit in Recent Years. For the 2019-20 school year, districts were only $49 million below the limit. The following year, districts initially exceeded the limit by $139 million. However, in February 2021, districts submitted updated budgets that reflected enrollment declines and shifts to distance learning due to COVID-19, resulting in the aggregate budgets falling $144 million below the limit.

In the seven years he has been governor, Doug Ducey has proposed, and the legislature has funded new programs and restored funding previously cut. These increases have contributed to Arizona’s district schools moving closer to the expenditure limit. These include:

- $581 million for teacher pay (20 X 2020)

- $69 million for results-based funding

- $12 million for early literacy

- $20 million for school resource officers and counselors

- $371 million to restore additional assistance

The Problem with the Limit. Arizona’s aggregate expenditure limit is outdated. It is based on education spending in the 1980s – before personal computers, the emphasis on STEM education, concerns about school safety, teacher shortages, and increased spending for special education students. Today, it threatens Arizona’s ability to make the investments needed to increase its per-student funding ranking above 48th.

A New Wrinkle – Replacing Prop 301, the Education Sales Tax. In November 2000, Arizona voters passed Proposition 301, which created a 0.6% education transaction privilege (sales) tax effective for 20 years. While some of the proceeds from Proposition 301 were used to support school facility bonds, universities, and community colleges, the majority of the funding went to K-12 schools. Two years after passing Prop 301, Arizona voters approved excluding Prop 301 spending from the K-12 aggregate expenditure limit.

The original Prop 301 sales tax expired on June 30, 2021. SB 1390, passed in 2018, became effective July 1, 2021, and extended the sales tax for another 20 years. As required by Arizona’s constitution for tax increases, SB 1390 passed with a two-thirds vote of both houses. Still, it was not sent to Arizona voters to exempt the expenditures from the successor tax from the spending limit. Legislative Council staff has advised that the expenditures funded by the successor tax are not exempt from the expenditure limit calculation. The Joint Legislative Budget Committee staff estimates this adds $632 million to the aggregate expenditures. The Board of Education included these funds as counting toward the limit when it released its November 1 calculation.

Prop 208, the High-Income Surcharge. In November 2020, Arizona voters approved a 3.5% income tax surcharge on high-income taxpayers that will be distributed to districts and charter schools for teacher and classroom support staff salaries, teacher mentoring and retention programs, and career and technical education programs. The Arizona Supreme Court has ruled that expenditures of Prop 208 revenue are subject to the expenditure limit and has directed the lower court to determine whether districts will exceed the expenditure limit as a result. The Prop 208 surcharge is not effective until January 1, 2022, and will not be distributed to districts until after the 2021-22 school year ends. How much districts and charters will receive will not be known until income tax returns are filed in 2022 and will be affected by the creation of the new small business category for filing individual income taxes, a category designed to circumvent the Prop 208 surcharge and, therefore, reduce how much revenue districts will receive. The lower court’s decision is pending.

Overriding the Limit. Arizona’s constitution allows school districts only one option to avoid budget cuts – a one-time override that must be passed, not by voters, but by the state legislature, and not by a simple majority but by two-thirds of both houses. Should this override approval not occur by the March 1 deadline, districts will be directed to reduce their budgets to keep within the limit.

To make a permanent change to the limit, either the legislature would need to refer the issue to the voters or signatures would need to be collected to place the issue on the ballot at a future general election. For the 2021-22 school year, there is only one option: Arizona’s legislature needs to pass an override for the 2021-22 school year by March 1, 2022.

Overriding the School Expenditure Limit Does Not Mean Increasing Taxes. The aggregate limit applies to the school districts’ current year budget, based on revenues already being received. The override authorizes districts to spend the budgets that have already been adopted – it does not increase property taxes.

Arizona’s Legislature Has Approved Exceeding the Limit in the Past. District budgets exceeded the expenditure limit in 2007, 2008, and 2009. The legislature overrode the limit in both 2007 and 2008. Mid-year funding cuts adopted by the legislature in 2009 resulted in the Superintendent of Public Instruction directing districts to reduce their budgets to account for fewer state dollars.

Districts Could Face Draconian Budget Cuts. If the Arizona legislature does not override the spending limit by March 1, 2022, school districts will be directed to reduce their expenditures and submit new budgets by April 1. These reductions and new budgets will apply to the school year that ends three months later, on June 30. School boards could face significant staff layoffs and other cuts just as standardized testing and other year-end events occur. The Department of Education has calculated the amount that each district would be required to cut from their budget if the legislature doesn’t pass the override by March 1.

The Spending Limit is Harming Low-Income Schools, Particularly Those that Serve Students of Color. Bonds and overrides, which can raise revenues to pay for expenses beyond the state funding formula and capital projects, do not count toward the expenditure limit. With higher property values and higher incomes, districts in high-wealth areas have more ability to pass and pay for bonds and overrides. Districts with lower property values and lower incomes do not have the same ability to pass and pay for bonds and overrides. (Charter schools receive a higher per-student amount from the state since they do not have the ability to assess property taxes, and they are not subject to the expenditure limit.)

Arizona’s Aggregate School Expenditure Limit is a Significant Barrier to Improving Our Public School System. In the 1979-80 school year, Arizona’s per-student spending was 87 percent of the national average. By the 2017-18 school year, Arizona was spending only 67 percent. Limiting spending based on an artificial expenditure limit hampers our ability to compete against other states to attract businesses with high-paying jobs.

Options for a More Permanent Fix to the Spending Limit. For the 2021-22 school year, the only option to avoid districts having to cut their budgets in the middle of the school year is for the legislature to pass a one-time override. But Arizona needs a permanent fix to the current expenditure limit. Here are some options for a permanent fix:

- Reset the Base Year. If Arizona retains the aggregate spending limit calculation, it needs to be based on what today’s public schools pay for – computers and technology, student safety, increased pay for teachers, and all other district staff. This option requires voter approval to amend the state constitution.

- Use the Weighted Student Count. Instead of using a student count that reflects just enrollment, a weighted student count would take into consideration the higher costs of providing education to students with special needs, small school districts, grade level, and English learners.

- Expand the List of What is Exempt from the Limit. The school spending limit should not include spending linked to school or student characteristics, such as increases in the number of special education students, students with disabilities, or English language learners, or the mix between elementary and secondary students.

Eliminate the Expenditure Limit Altogether. The K-12 aggregate spending limit was adopted at a time when major changes were being made to how the state’s public schools were to be funded, and concerns existed that these changes might result in significant tax increases. Today, we know that school spending is controlled in several ways. For example, the per-student base-level spending formula, the relationship between local property taxes and state funding, and even suspension or reversal of inflationary increases to per-student base-level funding if inflation and employment growth do not exceed 2 percent or K-12 education’s portion of the state general fund budget reaches 49 percent or more. Eliminating the expenditure limit does not mean eliminating all spending limits.