Criminal Justice Reform Is Good for the Economy and Advancing Equity

Taxation through court fines and fees is problematic

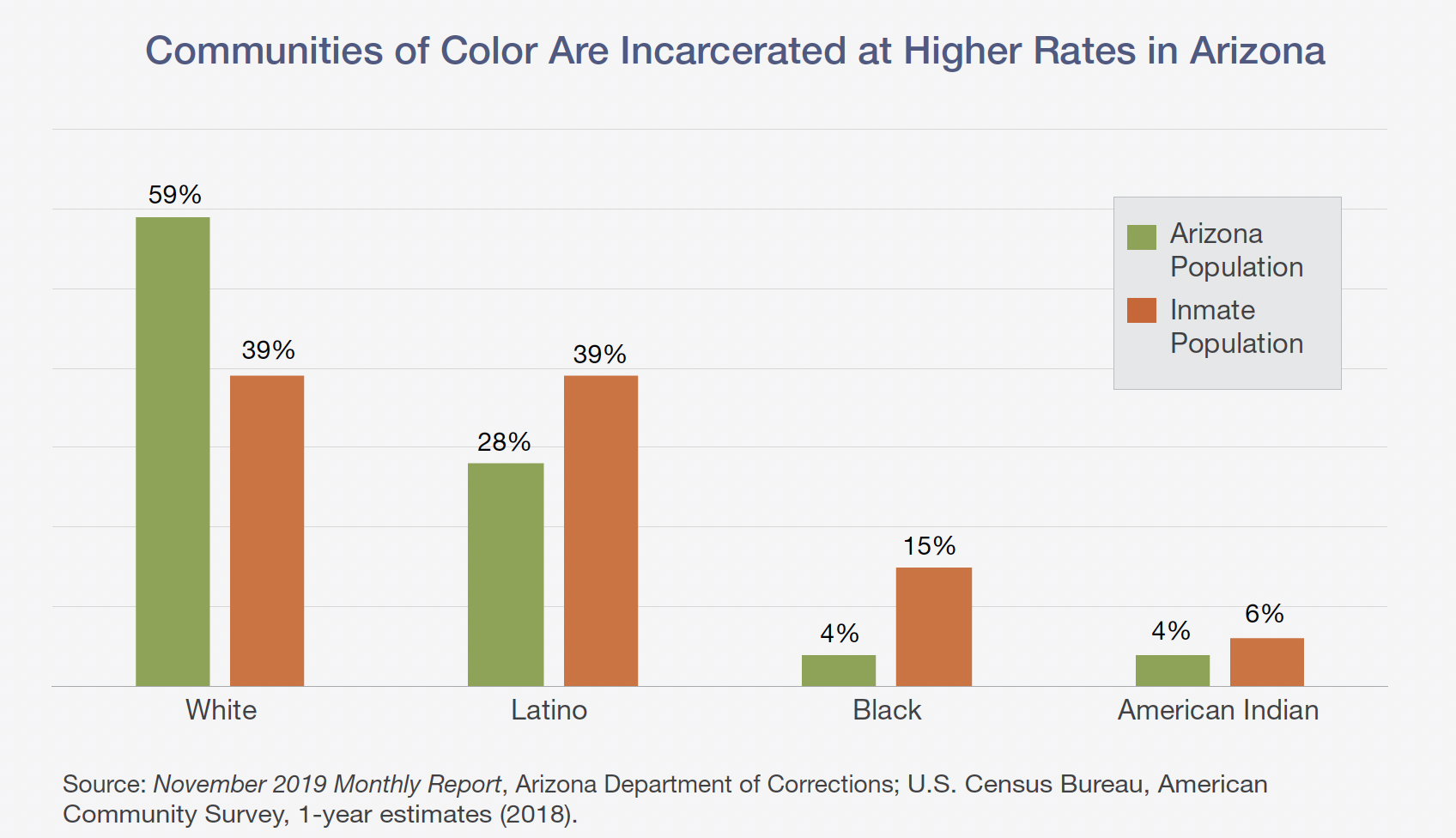

The most visible reforms targeted at the criminal justice system today center around policing, sentencing, and mass incarceration. While some parts of the Arizona criminal justice system are receiving more attention and funding today than a decade ago, other agencies, such as the court system, are receiving 13 percent less in general fund dollars. As Arizona’s legislature continues to cut more taxes, local governments have increased their dependency on money raised from court fines and fees. This practice has disproportionately burdened low-income communities and people of color with financial sanctions and uneven taxation.

Fines were designed to act as a punishment or a deterrent in the criminal justice system, yet fees do not advance the same purposes. Rather, the fees in Arizona have allowed the state legislature to cut general fund dollars needed to fund courts or other government functions.

For instance, in 1999, the state legislature enacted the State Aid to Indigent Defense Fund (also known as Fill the Gap funding) to provide additional resources to county public attorneys, indigent defense agencies, and courts to assist in reducing case processing time. The State Aid to Indigent Defense Fund balance is generated from 21 percent of fees collected by the Supreme Court and the Court of Appeals and 15 percent of surcharges from criminal offenses, civil traffic violations, and motor vehicle violations. Since fiscal year 2012, the funds have not been used as intended. For the past eight years the state legislature has redirected the revenue to the Arizona Attorney General’s Office and the Department of Public Safety to cover operating costs for the Counter Terrorism Information Center. As courts are pressured to act as the collection arms of the state, policymakers need to consider the array of collateral consequences and options to raise revenue without disproportionately impacting low-income individuals and communities of color.

All Arizonans have an interest in a justice system that keeps us safe, is just, and is working to rehabilitate individuals reentering into our communities. Today, Arizona has the fifth highest incarceration rate in the nation, and a stagnant recidivism rate with more than one in two individuals returning to prison.

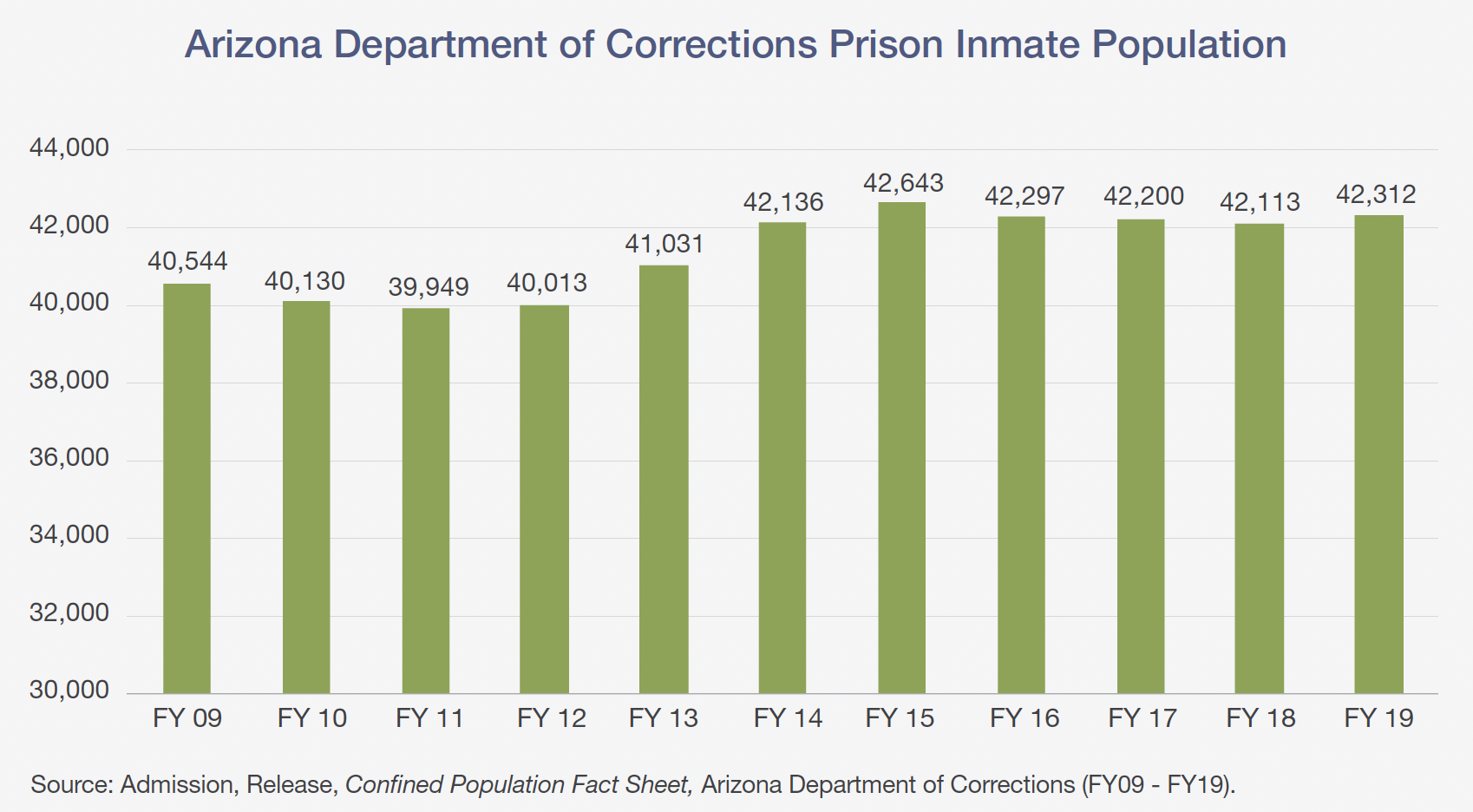

At a time when other states are adopting policies to curb prison population growth and pursue effective policy solutions, Arizona is falling behind. Instead, the Arizona Department of Corrections budget has more than doubled since 2000 and comprises 10 percent of the state’s expenditure’s at nearly $1.2 billion. This annual figure addresses only the cost of operating the state prison system, leaving out policing, courts, county jail, probation and the cost paid by families. According to the most recent National Association of State Budget Officers report, Arizona ranks second highest among all 50 states in the percentage of total general fund expenditures on corrections.

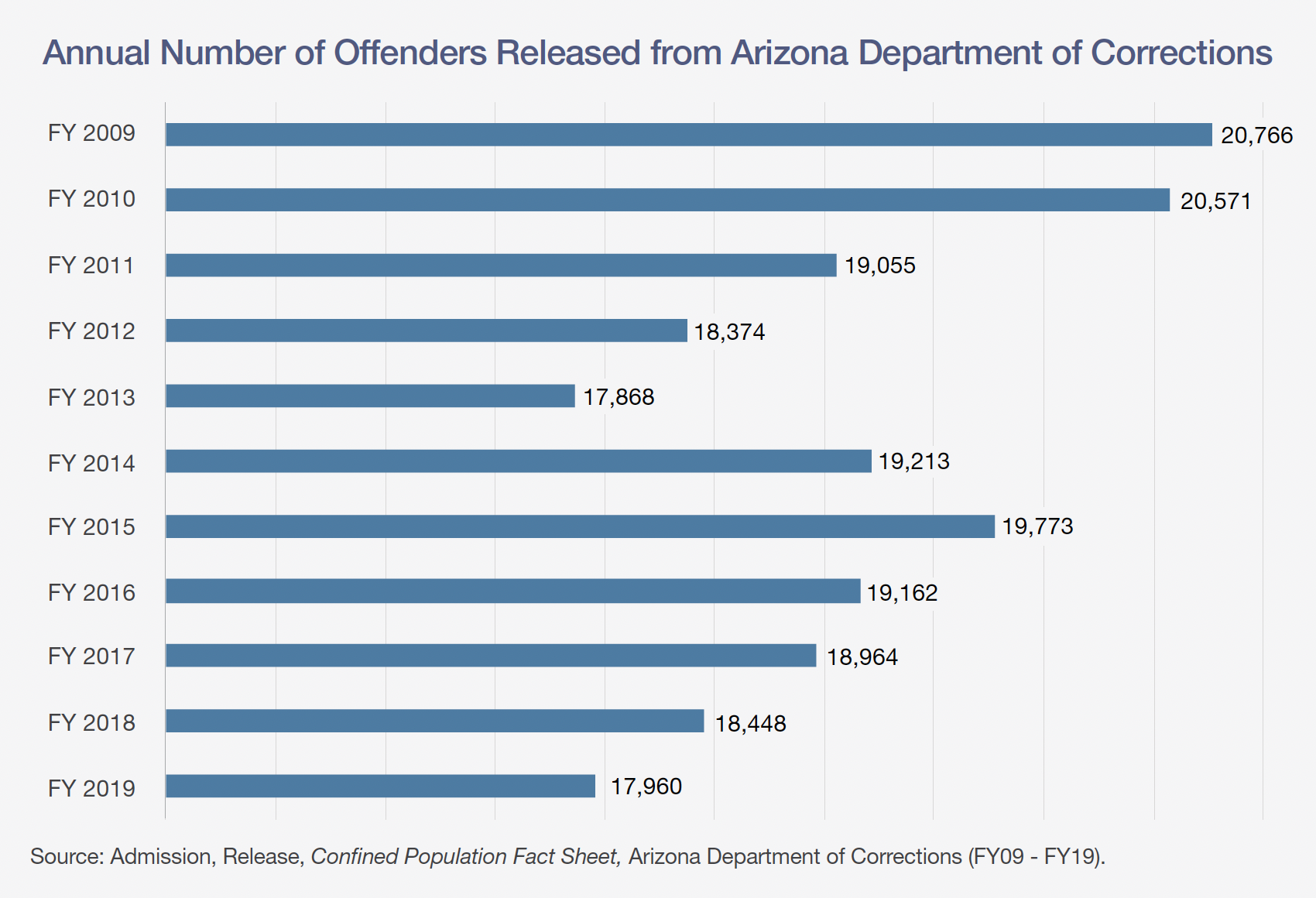

In 2019, nearly 18,000 individuals left prison in Arizona. To help re-integrate with society and join the workforce, skill-building and treatment services are imperative. At any given time, 75 percent of the prison population is flagged for moderate to intense substance abuse treatment. Yet, the Arizona Department of Corrections (DOC) is failing to provide these key programs and services. In fiscal year 2018, DOC provided less than five percent of the prison population with career and technical education and two percent with substance abuse treatment services.

The state’s high imprisonment rate is hurting Arizona’s economy, communities, and families. The State of Arizona removes thousands of people from the economy and costs taxpayers more than $1 billion each year preventing the state from investing in other critical priorities such as K-12 education, postsecondary education, workforce development, and child care programming for working families.