Governor Ducey's budget proposal

At a time when Arizona is experiencing among the highest rates of COVID in the nation and world, it is critical to examine how the state allocates its resources to address the needs of struggling Arizonans.

Amidst the onset of the pandemic last spring, the Arizona legislature hurriedly passed a basic “skinny budget” and adjourned. At the time, official forecasts predicted a $1.1 billion shortfall for the fiscal year ending June 30, 2020. But unexpectedly, instead of a shortfall, the state’s ending positive balance was more than $370 million. Income tax withholding has increased rather than decreased. Sales tax revenues also have increased as Arizonans shift from purchasing services, which generally are not taxed, to purchasing goods, which are taxed. An infusion of federal aid to individuals and state government, including about $396 million in federal COVID relief dollars that Governor Ducey used to substitute for General Fund dollars to pay for state agency operations. Increased federal unemployment payments and two rounds of stimulus checks also contributed to what the governor’s budget projects is a $1.1 billion ending cash balance for fiscal year 2021 and a projected $923 million revenue surplus, after the governor’s spending proposal, for the coming fiscal year.

Yet, nearly 2.5 million Arizona households have had at least one member that lost employment income since the pandemic began, particularly households of color, households with children, or low-income households). Unable to find new employment, these workers are depending on unemployment insurance, personal savings, stimulus payments, and food banks to make ends meet. These Arizonans are counting on a state budget that will prioritize the investments needed to support them and their families as they struggle to recover from this health and economic crisis.

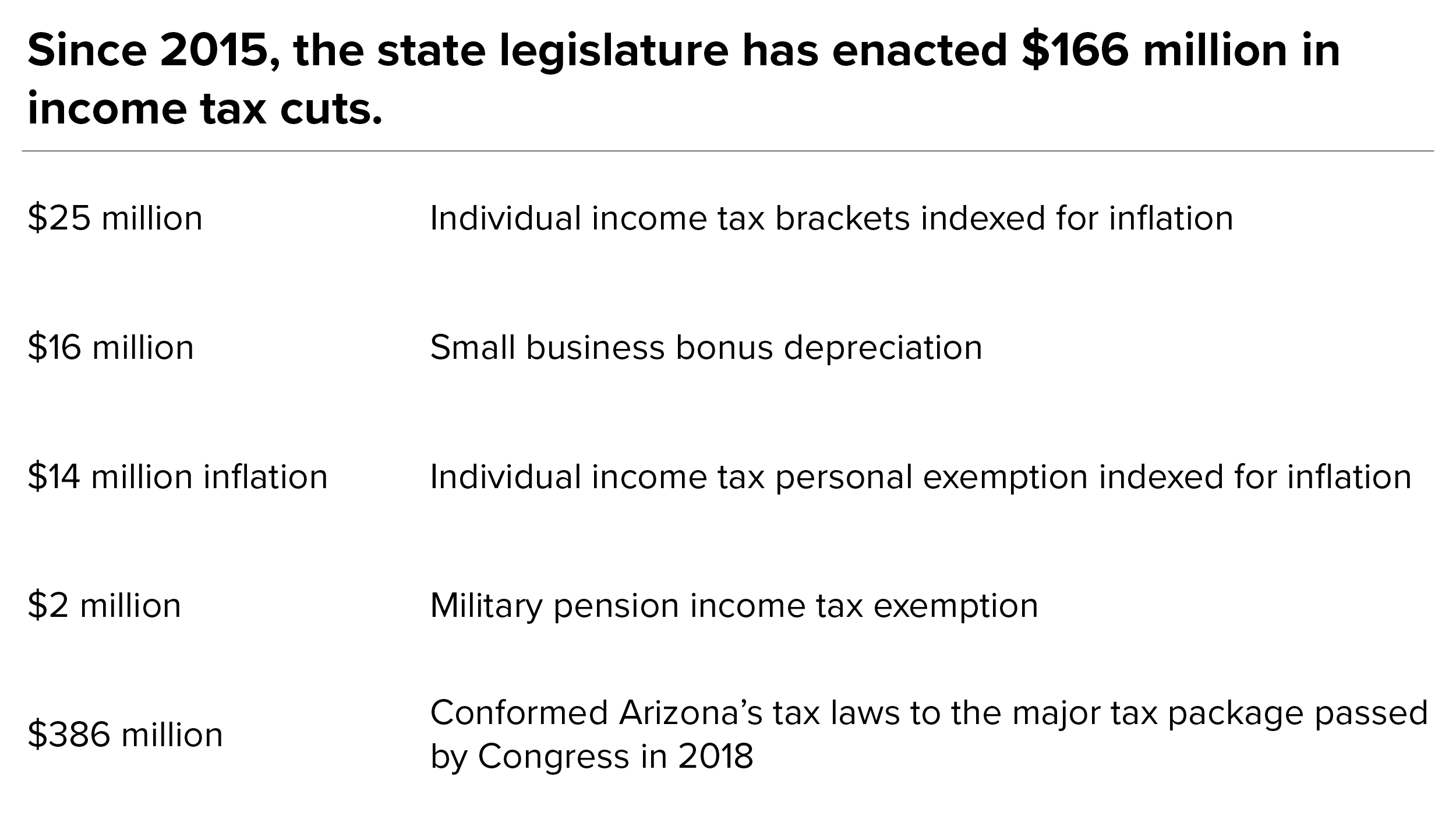

Governor Ducey recently released his proposed budget, providing insight into what to expect as lawmakers begin crafting their own in the coming weeks. The centerpiece of the Governor’s budget is a phased-in, unspecified tax cut which would grow to a cost of $600 million annually within three years. If passed and combined with the $386 million in tax cuts enacted in 2019 to offset the effect of the major tax changes passed by Congress, would amount to $1 billion less in revenue each year.

Missing from the Governor’s budget proposal are the investments Arizonans need to weather this economic and health crisis and thrive and prosper beyond:

- Paid family and medical leave for all Arizonans.

- Safe and affordable housing.

- Internet access for all.

- Quality affordable child care for every parent.

- Quality public education from early childhood to postsecondary education.

- Access to food security no matter where you live.

- Increasing Arizona’s weekly unemployment benefit amount (currently second lowest in U.S.).

What's in the Governor's budget

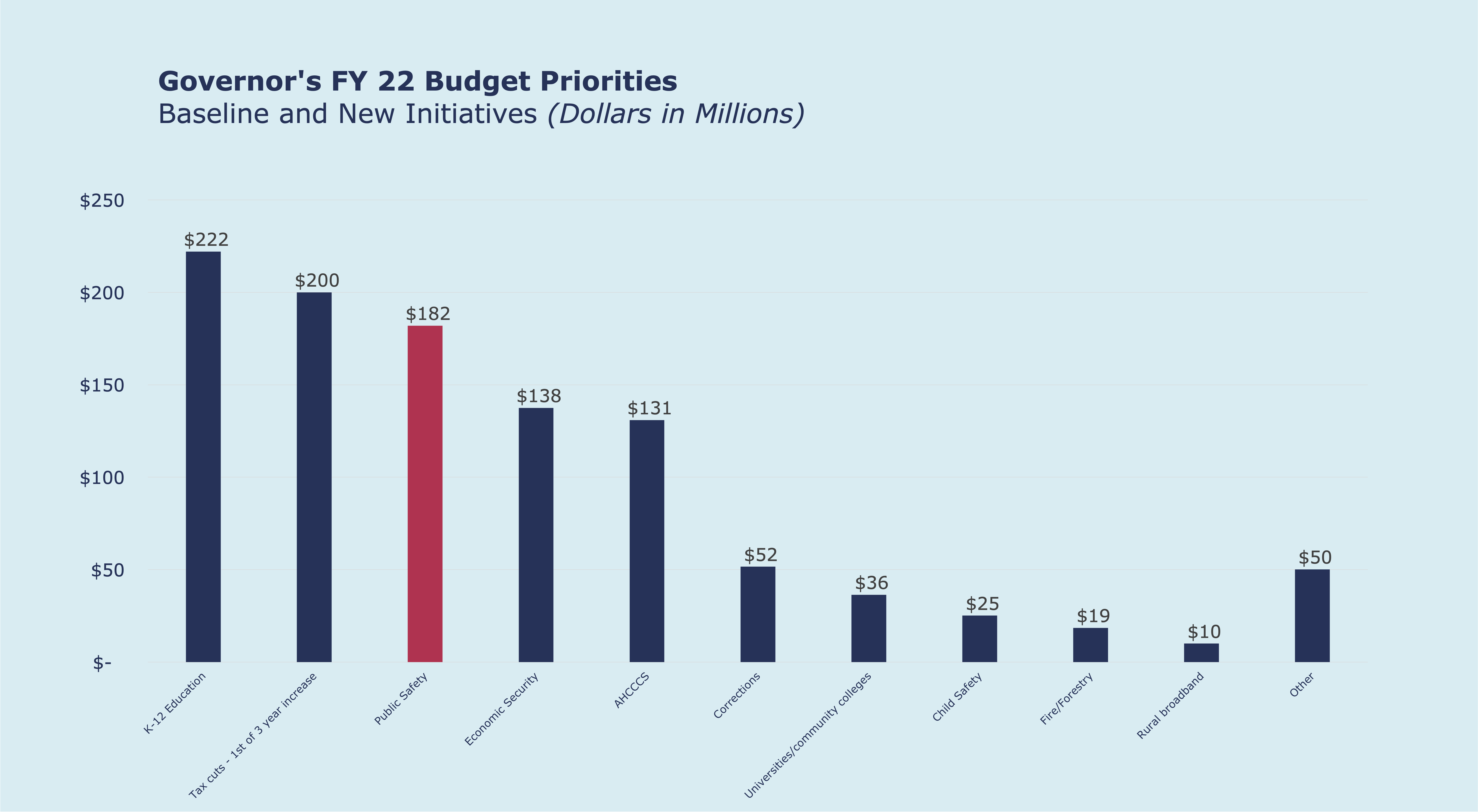

The Governor’s budget includes $580 million in baseline changes – adjustments required by state statutes and other obligations. This includes changes to K-12 and AHCCCS enrollment, statutorily required inflation, and adjustments to the state match requirements for federal programs such as AHCCCS.

The Governor’s budget also includes $292 million for new initiatives, including:

- Department of Education/Board of Education - $31 million for early literacy support, support for the Arizona Personalized Learning Network, grants to transport students to schools out of their home district, and other initiatives.

- Universities - $35 million to fund the New Economy Initiative.

- Department of Child Safety - $25 million to implement the requirements of the Family First Prevention Services Act.

- Department of Public Safety - $21 million for overtime, recruitment and retention efforts, and the purchase of body cameras.

- Department of Corrections - $26 million for increased substance abuse treatment and the purchase of staff safety equipment. The increase also funds the increased cost of closing the Florence prison and moving the inmates to private prisons. An additional $26 million is requested through the capital budget to fund fire and life safety projects at the Eyman prison.

- Department of Economic Security - $4 million to add Adult Protective Services staff and to provide rate increases for Adult and Aging Services.

- Department of Forestry and Fire Management - $18.5 million for FY 2022 as well as additional appropriations for FY 2023 and FY 2024 to add staff and to create inmate crews for hazardous vegetation removal.

The Governor’s budget also includes an unidentified tax cut that begins at $200 million in FY 2022 and grows to $600 million in FY 2024. If passed, the Governor will have enacted $1 billion in tax cuts since 2015. As we move through 2021, the Governor and state lawmakers should address the health and economic crisis of the pandemic and work to uplift struggling Arizonans and their families. Check out our Budget 101 and Peoples First Economy campaign.