Increase Food Assistance Now

Job loss and reductions to income related to COVID-19 have put a strain on family budgets. A new national survey from the Urban Institute found that 3 in 10 nonelderly adults have reduced spending on food, with nearly half of those who lost work or income doing so. Food insecurity (defined as a limited or certain unavailability of a nutritionally adequate diet) was the most commonly reported hardship among all adults and among adults in families who lost work or income. Even before COVID, studies showed food insecurity disproportionately affects low-income Hispanic and black adults, and emerging evidence suggests American Indian/Native American households (of whom many already struggle with food insecurity) are being hard hit by the COVID-19 pandemic.

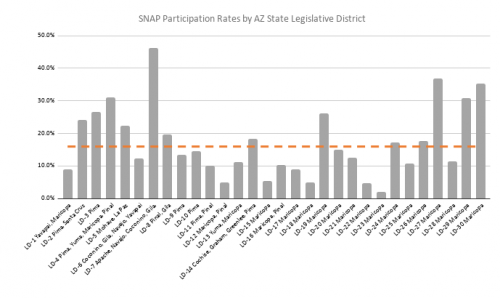

The federal Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, provides critical support for low-income households and serves as a strong public investment during a weak economy. According to data from the Arizona Department of Economic Security, nearly 1 in 6 Arizona households benefited from SNAP in 2018. As our analysis shows, low-income Arizonans from across the State participate in SNAP, across all counties and legislative districts.

Arizonans participating in SNAP most commonly work in service, office, and sales jobs. Given the economic shock that COVID-19 has had on employees in these industries as public health measures are implemented and jobsites close, it’s time to for Congress to boost SNAP benefits. While some flexibility for SNAP has been implemented, more is needed to address the current economic fallout. Just as was done in the Great Recession, Congress should raise the SNAP maximum benefit by 15% to make sure households can afford nutritious meals during the economic crisis.