“Repeal and replace” tax scheme erases Prop. 307 and the voice of Arizona voters

Last year, the Arizona Legislature and Governor Doug Ducey enacted a huge tax cut for the wealthiest households in the state. In so doing, they squandered a historic opportunity to direct massive surpluses towards communities that struggled the most during the COVID-19 pandemic, and for whom decades of cuts to public schools, housing, and child care, have hurt the most. In response, hundreds of Arizonans organized in the summer of 2021—during the pandemic—to collect the signatures needed to block those tax cuts from going into effect until voters have the final say by referendum on the November 2022 ballot, known as Proposition 307.

But the legislators and the Governor haven’t stopped. Instead of letting the voters decide, they are trying an end-run around the referendum by repealing and replacing the tax cut, changing it to make Proposition 307 invalid, and remove it from the ballot. Voters have made it clear that more giveaway tax cuts for the wealthy are not the way to invest in Arizona’s future.

What tax giveaway to the wealthy did the Legislature and Governor enact in 2021?

In 2021, politicians at the State Capitol had a historic opportunity to use a massive surplus of state and federal resources to make long-term investments and improve the economic well-being of Arizonans. Instead, they gave billions of dollars to the wealthiest households, ignoring the will of voters who had passed Proposition 208 in 2020. The enacted budget which cut nearly $2 billion in taxes—was the most blatant in a long tradition of prioritizing tax cuts, credits, and deductions that tilt the scales of state finances in favor of the wealthiest households and corporations. The plan to lower income taxes to a 2.5% rate for all households (known as the “flat tax”) will result in 63% of the benefits going to the top 5% of households (those making more than $248,000). While households in the top 5% will benefit by thousands of dollars, the average tax benefit for middle-income households is a mere $58.

The current income tax, with its tiered structure, is the only progressive tax in Arizona (where those with higher incomes pay more). While proponents of the “flat tax” claim it creates fairness, when all elements of the tax code are taken together, it worsens a regressive tax structure.

What is a “progressive” and “regressive” tax?

These terms have to do with who pays more for a given tax, as a share of their income.

A progressive tax system has higher taxes for those with higher incomes and the wealthy.

A regressive tax system has those with lower incomes pay more (as a share of their income).

While “flat taxes” (like Arizona’s sales tax, for example) is applied for purchases regardless of who is buying, it is regressive because it demands a larger share from lower-income households.

Cutting income taxes forces Arizona to rely on its regressive sales tax to fund public services, meaning that lower-income households will still pay significantly more in taxes (as a share of their income, after deductions and credits) than the wealthiest households in the state. Families in the lowest 20 percent continue to pay twice what families in the top 5% do - $131 compared to $65 for every $1,000 of income, respectively.

While Arizona’s tax structure didn’t independently create income and wealth gaps, it has perpetuated inequities year after year, including disparate impacts on people of color. A disproportionate share of lower-income households in Arizona are American Indian, Black, and Latinx. When all types of state and local taxes are combined (income, sales, and property), these households pay nearly 9.7 cents of every dollar they make towards taxes, compared to just 7.3 centers on the dollar for white households. The tax cut passed last year would worsen this inequality, with 79 percent of the benefits accruing to white households.

How did Arizonans respond to last year’s tax cut and what is Proposition 307 (the referendum)?

Reducing state revenues by $2 billion makes it virtually impossible to adequately fund public schools, infrastructure, and other public services that help the economic well-being of Arizonans. While Arizona’s constitution only requires a simple majority of the legislature to cut taxes, it requires a supermajority to reverse tax cuts or raise revenue of legislators to raise revenue.

In response to the tax cuts, the Arizona Center for Economic Progress and its partners launched the Invest in Arizona Now referendum campaign, collecting the tens of thousands of signatures required to stop the newly-passed tax cuts from going into effect and let voters have the final say on the 2022 general election ballot.

Braving the brutal Arizona summer temperatures and amidst the COVID-19 pandemic, volunteers across the state organized in their communities to collect the paper signatures. Since the tax cuts were enacted across three separate pieces of legislation, volunteers carried three separate petitions.

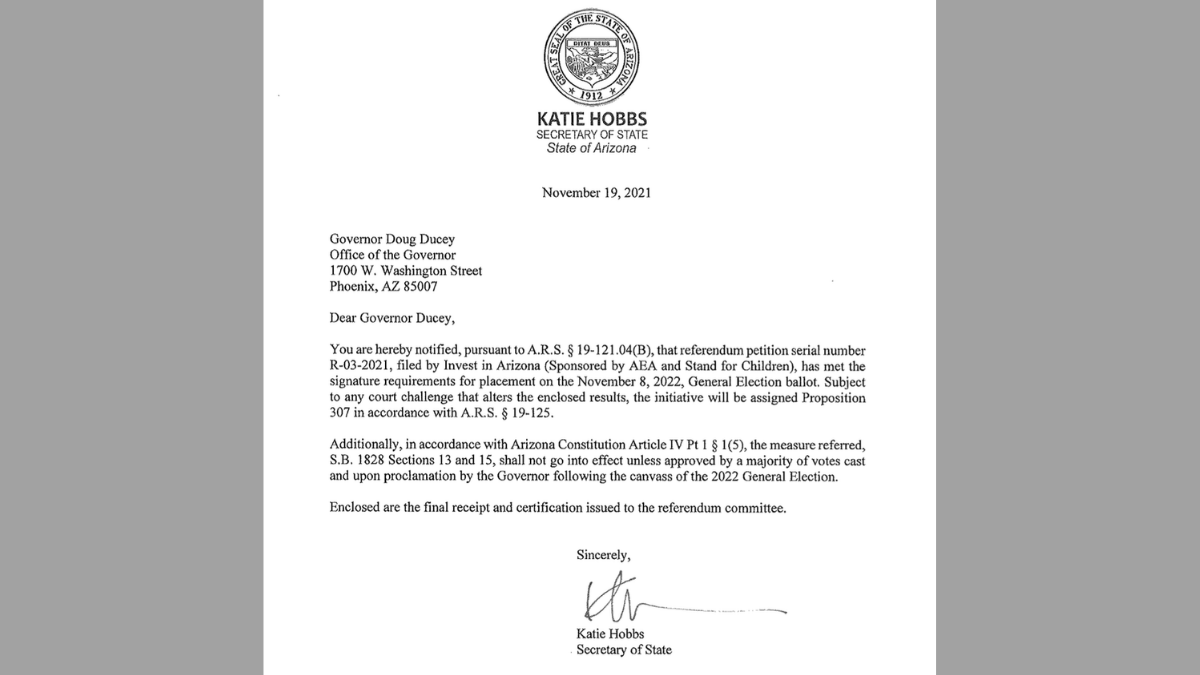

On September 28, 2021, the Invest in Arizona Now coalition submitted its signatures. While the referendum petition for two of the tax measures failed to reach the signature target, the petition to block the “flat tax” yielded more than enough signatures to qualify for the ballot. On November 19, 2021, the Arizona Secretary of State certified that enough valid signatures were collected, and officially named the referendum as Proposition 307, which would appear on the November 2022 general election ballot.

What is “repeal and replace” and why is it a bad idea?

While the voters have made it clear that the tax cut giveaway deserves to be put to the voters in 2022, the Arizona Legislature and Governor Ducey have planned an end-run around Proposition 307. Members of the legislature have indicated that a special session will be held to repeal the tax cut and replace it with a modified proposal (hence a proposal to “repeal and replace”). While the replacement legislation might only differ slightly from the original tax cut proposal, it would make Proposition 307 invalid as voters would no longer be weighing-in on current law.

Some lawmakers are emboldened to cut taxes further because Arizona’s General Fund surplus continues to climb thanks to the economic recovery. However, this is misguided and potentially fiscally irresponsible because much of the revenue surplus is likely temporary (thanks to federal COVID-19 aid distributed in 2021). While Arizona’s constitution only requires a simple majority of the legislature to cut taxes, it requires a supermajority to reverse tax cuts or raise revenue of legislators to raise revenue – something that has proven to be virtually impossible for the past three decades. If revenues decline in the future, this could mean that Arizona, despite having a massive surplus this year, may need to cut public services, just as was done during the Great Recession.

Instead of throwing away Arizona’s future through needless tax cuts for the wealthiest households, Arizona’s legislature can use the current surpluses to make significant investments in long-neglected sectors, like housing, child care, public schools, paid family and medical leave, health coverage, broadband, job training and so much more.