SB1682 Fact Sheet

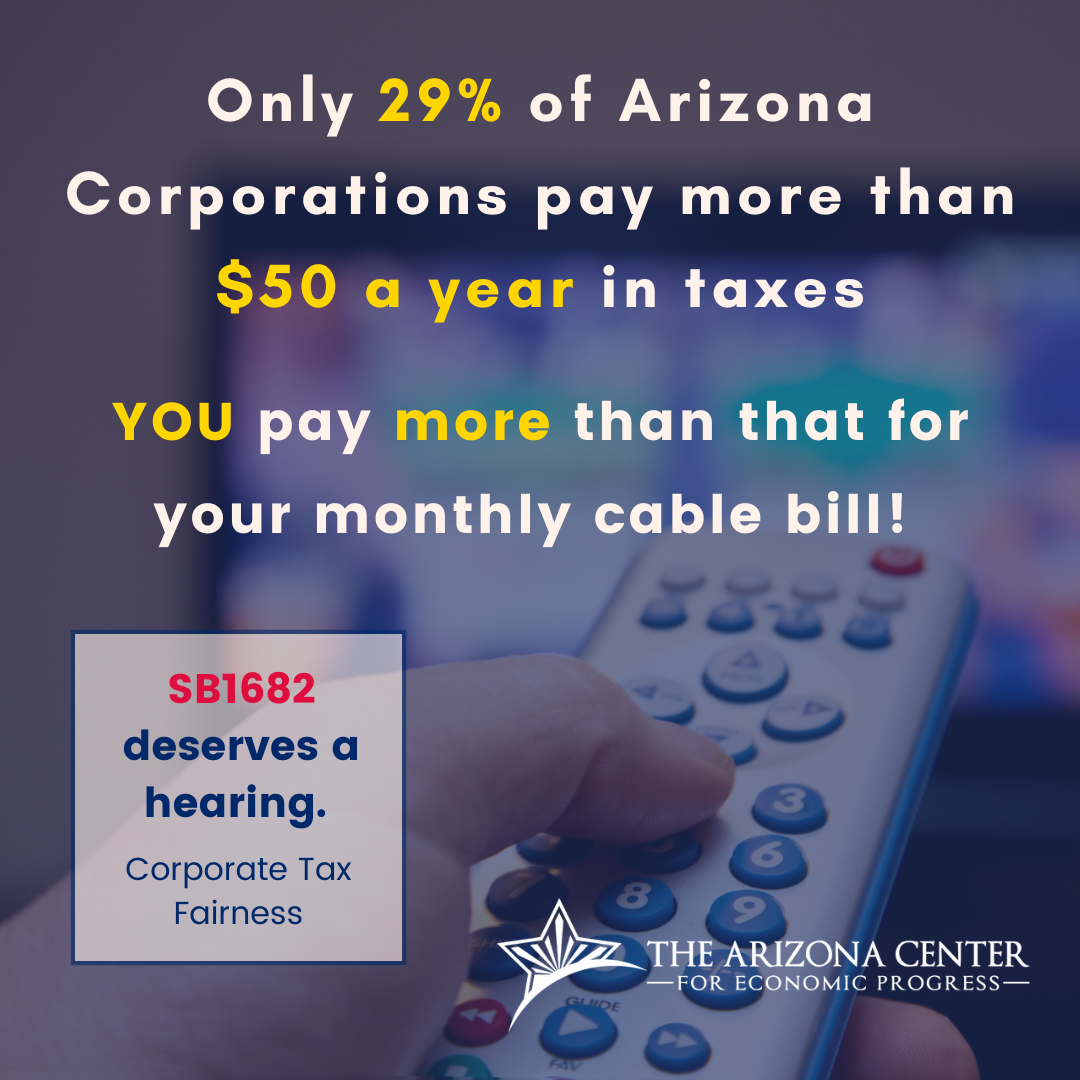

In Arizona, only 29 percent of corporations pay more than $50 in state income taxes. Most of us pay more than that for our monthly phone bill. For more than 30 years, corporations have received billions of dollars of tax breaks at the State Capitol, leaving less revenue to support public schools, health care and other critical services that Arizonans and our economy all benefit from. SB1682 will repeal one of those massive tax breaks given to large profitable corporations doing business in Arizona.

When a corporation produces and/or sells goods and services in more than one state, each state requires the business to pay tax on just a portion of its profit. The rationale being that each state should tax the business on the share of profits that are attributable to that state. There are many factors that should go into determining how much of a corporation’s profits are attributable to the state. Take, for example, a manufacturing company that owns several large factories in Arizona and employs hundreds of workers at those factories but sells everything they produce outside of Arizona. While all of the company’s sales that generate its profits may occur outside of Arizona, that does not take into consideration the significant contributions that Arizona makes toward that company’s profits, including all of the state services the company receives. The state provides roads and other transportation services to allow access to factories by the company’s suppliers and employees and for the shipment of its products to the other states. The state and local governments provide police and fire protection for the corporation’s property and employees. The state also funds K-12 public schools and higher education services that created the skilled workforce that the business relies upon.

Fair tax law should take into consideration both how much of a corporation’s sales occur in the state and also how much of the corporation’s operations and payroll occur in the state. But that is not how we do it Arizona. In Arizona, we actually allow these large corporations to choose the method that is used to determine how much they owe: one that either favors corporations with a larger portion of their sales in the state or one that favors corporations with a larger portion of their property/operations in the state. Naturally, corporations are likely to choose the formula that results in the lowest tax liability.

SB1682 will end that practice and will instead calculate how much these large profitable corporations owe based both on the amount of their sales and the size of their operations in Arizona. It is only fair that if these corporations are going to benefit from our public schools and universities, and from our roads, first responders, and many other state services, that they should pay their fair share like the rest of us.