Support Our Workers: Vote No on Prop 138

Outside pressures and situations such as the COVID-19 pandemic have resulted in higher costs for things we all need.

This means both workers and businesses are still working on recovering from all these pressures. While our economy is growing and income and poverty levels have slightly improved, many Arizona workers are still struggling to make a living wage, and this is especially true for tipped workers.

Yet, Arizonans are considering a ballot measure this election that, if passed, will cut the minimum wage employers pay tipped workers.

Arizonan voters last voted on the tipped minimum wage in 2006 when they elected to pass Proposition 202. At that time, the tipped minimum wage was set to $3 less than the state’s regular minimum wage. When the non-tipped minimum wage increased to $6.75 per hour, the tipped minimum wage was also subsequently increased from $2.13 to $3.75 per hour.

Who is a tipped worker?

A tipped worker is an employee who customarily and regularly receives tips or gratuities from patrons or others. Tipped workers usually work at full-service restaurants, hotels, nail salons and other service and hospitality industries. Workers in limited-service restaurants are usually considered non-tipped workers.

Today, Prop 138 threatens to reverse wage gains tipped workers have received in over the last seventeen years by cutting wages for those who earn $2 above the non-tipped minimum wage including tips. This would significantly worsen the economic well-being of tipped workers and their families by further reducing their wages under an even more convoluted tiered system.

Cuts wages for tipped workers and increases wage disparities

Under current law, the minimum wage for tipped workers in Arizona is set at $3 less than the non-tipped minimum wage. With the non-tipped minimum wage now at $14.35 per hour in 2024, tipped minimum wage is currently $11.35 per hour. To account for this difference, tipped workers must rely on tips to earn at least the non-tipped minimum wage, a tip reliance of about 21 percent.

Compared to most other states, Arizona’s 21 percent reliance on tips is among the lowest in the nation. In states with minimum wages set at the federal level of $2.13 per hour for tipped workers and $7.25 per hour for non-tipped workers, tipped workers rely on tips for 71 percent of their wages. Current wage policy in Arizona results in more predictable income for tipped workers compared to states that leave workers relying on tips for 71 percent of their wages.

What is Prop 138?

It is a proposed state constitutional amendment that would allow employers to pay tipped employees (who earn $2 above the state’s regular minimum wage) 25 percent less than the state’s regular minimum wage.

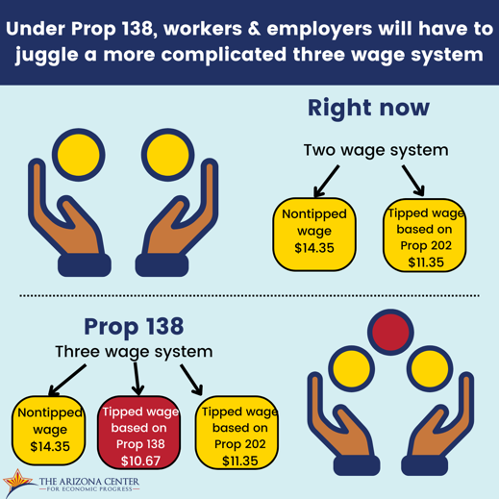

Since 2007, state law allows employers to pay tipped workers $3 less than the regular minimum wage paid to nontipped employees. Prop 138 would keep this tipped wage for tipped workers who make the nontipped wage with tips. But Prop 138 would add a 3rd wage for tipped workers who make $2 above the non-tipped minimum wage.

If passed however, Prop 138 would cut wages in a way that would increase Arizona’s tip reliance to 25 percent, creating a new tipped minimum wage of $10.76 per hour if it were in effect today. This is a $0.59 per hour wage cut that calculates to a $1,227 annual cut for full-time, tipped workers.

As Arizona’s non-tipped minimum wage increases with inflation adjustments however, proposed Prop 138 wage cuts will create even greater disparities for tipped workers. If Arizona’s non-tipped minimum wage increased to $16.23 in 2029, tipped minimum wage would be $12.17 per hour. This resulting $1.05 per hour wage cut would calculate to a $2,184 annual loss for a full-time tipped worker.

Tipped workers in Arizona cannot afford larger wage cuts

Under the current $3 wage difference, the real median wage for tipped workers in 2023 dollars is $15.78 per hour.2 This is nowhere near the median living wage Arizonan workers need to afford basic needs for themselves and their families. Single parents have an estimated living wage of at least $30.82 per hour in Arizona. For single parents with one child without access to resources like childcare or employer-provided healthcare, this living wage amounts to $38.05 per hour. Given that women make up 70 percent of tipped workers in Arizona, larger wage cuts as cost-of-living increases means single mothers and their children would be disproportionately harmed by Prop 138.

As larger share of Arizona households face steep price pressures, tipped workers would find even more difficultly under a Prop 138 wage cut. Recent 1-year data from the U.S. Census Bureau’s American Community Survey reveals that the share of cost-burdened renters in Arizona are higher compared to pre-pandemic levels. Households are considered cost-burdened when they spend 30 percent or more of their income on rent. In 2023, 54 percent of renters in Arizona reported being housing-cost-burdened compared to 46.5 percent in 2019. Felt at all income levels, Arizona is one of five states where more than 40 percent of middle-income renters spend 30 percent or more of their income on rent.

A widening wage gap between nontipped and tipped workers also means higher poverty

Prop 138 would further widen the wage gap between non-tipped and tipped workers over time, a trend further exacerbated by high inflation rates.

Data tells us that poverty rates for tipped workers is higher than non-tipped workers when a wage gap exists between the two. In fact, tipped workers in states with larger wage gaps experience poverty at more than double the rate of non-tipped workers, with waitstaff and bartenders at triple the rate.

Under Arizona’s current two-wage gap, tipped workers already experience nearly double the rate of poverty experienced among nontipped workers. These rates are even higher for tipped workers who are women. Prop 138 could increase the number of tipped workers in poverty.

Prop 138 opens opportunities for even more wage violations

Not only would Prop 138 cut wages and increase wage disparities between nontipped and tipped workers, but it would also further complicate an already convoluted wage system.

While tipped minimum wage laws require employers to pay up to the non-tipped minimum wage when tipped workers do not make up the difference in tips, this rarely happens. Both workers and employers in two-tiered wage system states like Arizona find it nearly impossible to calculate how many tips were earned through cash vs. credit card transactions or what duties count as non-tipped vs. tipped. The current two-wage system is already incredibly complicated, creating harmful incentives that make tipped workers victims of wage theft at much higher rates than non-tipped workers.

In investigations of over 9,000 restaurants from 2010 to 2012, the U.S. Department of Labor (USDOL) found that 84 percent of investigated full-service restaurants had some kind of wage violation. This included about 1,200 violations of the employer requirement to pay up to the nontipped minimum wage when their tipped employees did not make enough in tips. Tipped minimum wage expert, Sylvia Allegretto, found a similar share of wage violation of 85.3 percent in analyzing USDOL enforcement data from 2010-2019.

A recent Fifth Circuit decision may further complicate these wage calculations for tipped workers in the near future. This decision allows employers to assign nontipped duties to tipped workers for more than 20 percent of their work time and more likely pay the lower, tipped minimum wage for these duties. This could create further difficulties for workers relying on tips to meet the nontipped minimum income amount.

Prop 138 would only further complicate our wage system by adding a second tipped minimum wage for tipped workers who make $2 above the tipped minimum wage thus creating a new, three-tied wage system in Arizona.

Erasing nearly twenty years of progress for tipped wages in Arizona

By cutting wages, increasing the wage gap between tipped and nontipped workers, and creating an even more complicated three-tiered wage system, Prop 138 will slowly erase significant progress for tipped workers in Arizona over the last seventeen years.

Minimum wages for both non-tipped and tipped workers in Arizona were set at the $5.15 and $2.13 federal levels prior to 2007. Thanks to Arizona voter passage of Prop 202 in 2006, the tipped minimum wage has significantly increased compared to today’s federal tipped minimum at $2.13. As a result, the share of reliance on tips or the gap between the non-tipped and tipped minimum wages for Arizona workers has shrunk from 59 percent in 2006 to 21 percent today.

In contrast, the share of reliance on tips for tip workers living in states that follow federal minimum wage has increased from 59 percent to 71 percent. As explained in the sections above, we know that wider wage gaps between non-tipped and tipped workers makes it difficult for tipped workers to pay for basic needs and more likely for them to experience poverty.

Since the passage of Props 202 and 206, the real value of the tipped minimum wage has made significant progress while the value of the Federal tipped minimum wage has declined. The real value in 2023 dollars of the tipped minimum wage in Arizona has increased from $3.32 per hour to $10.85 per hour from 2004 through 2023. Yet, the real value of the Federal tipped minimum wage has decreased from $3.32 in 2024 to $2.13 in 2023.

Prop 138 will reverse almost 20 years of voter-mandated progress for tipped workers in Arizona.

Vote NO on Prop 138!